Winter made itself known again this past week here in the Cowichan Valley. A cold snap led to a bit of the white stuff falling on the last day of January.

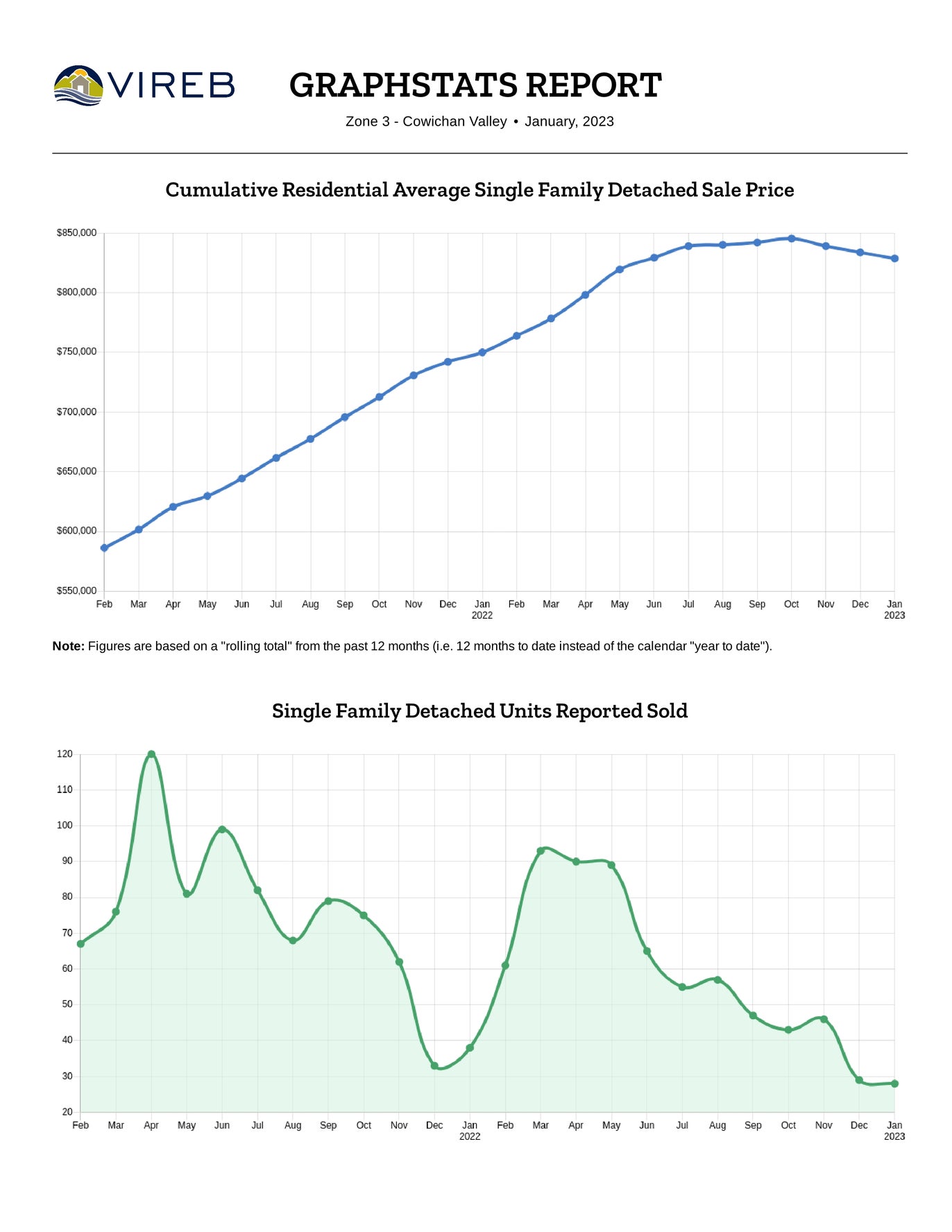

January saw a total of 28 single-family homes sold in the Cowichan Valley, down about 26% from the 38 that sold in January of last year, and 1 fewer than the 29 homes sold in the preceding month of December. There were 66 single-family homes listed on the market in January 2023 compared to 53 last year, up 25%. There were 703 sales in our valley over the past 12 months representing a 20% decrease in comparison to the 880 sales in the 12 months ending in January of last year.

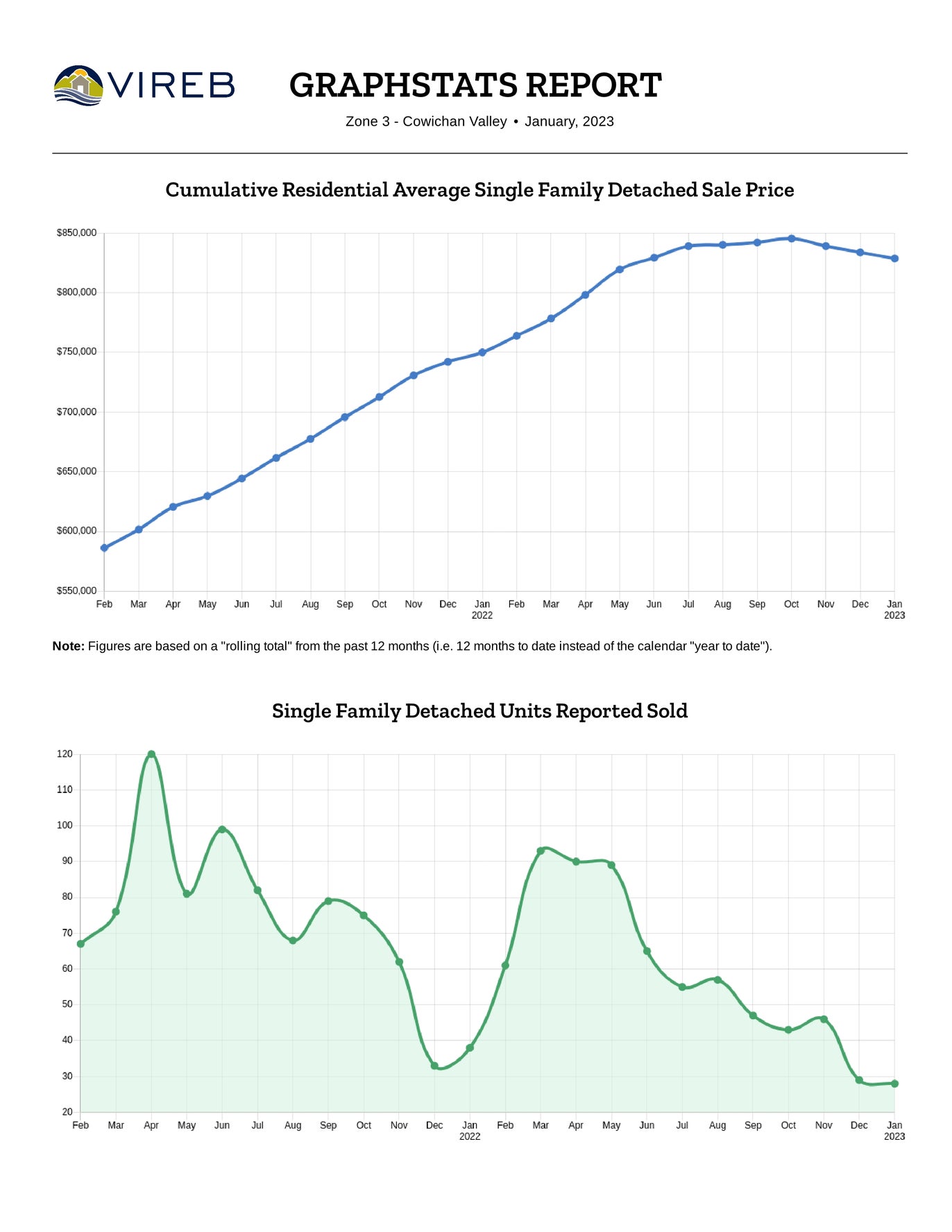

Average prices for single-family residential homes in January 2023 were at $683,863, down 16% from $816,924 in January 2022, and down from December’s average of $738,207. The median price of a single-family home in the Cowichan Valley for the 12 months to date ending in January 2023 was $799,900.

In January the active inventory of single-family homes on the market in the Cowichan Valley was 254, up substantially when compared to 78 homes at the end of last January 2022.

Property assessments have been updated for 2023 and they have increased noticeably on Vancouver Island and particularly here in the valley.

January Sales Stats for Single Family Homes in the Cowichan Valley

Average prices for single-family residential homes in January 2023 were at $683,863, down 16% from $816,924 in January 2022, and down from December’s average of $738,207. The median price of a single-family home in the Cowichan Valley for the 12 months to date ending in January 2023 was $799,900.

In January the active inventory of single-family homes on the market in the Cowichan Valley was 254, up substantially when compared to 78 homes at the end of last January 2022.

Currently, we have a 6.9-month supply of single-family homes on the market, while January 2022 had a 1.5-month supply. The average days to sell a single-family home in January was 67 days, compared to 8 days last January.

Condos & Townhouses

Condominium apartment sales in January saw 9 units sold, up from 3 sales in the previous month of December, and down from the 11 that sold last January. Condo apartments in the valley saw the average price for the 12 months ending in January 2022 at $358,120; that's up 19% compared to last year.

The inventory of Townhomes on the market saw 5 sales in January, up one from the 4 that sold in the month of December, and down many from the 11 sold last January. Townhomes in the valley saw the average price for the 12 months to date ending in for January at $615,642, up a considerable 20% from $513,824 for the same period last year.

Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.3 per cent on a year-over-year basis in December, a decrease from the 6.8 per cent rate in November. Falling gasoline (-13.1 per cent month on month) and fuel oil prices drove the decline, while softening costs for durable goods such as furniture and used vehicles also slowed price appreciation. Rising interest rates contributed to an increase in mortgage interest costs, which were up 18 per cent year-over-year as Canadians renewed or initiated higher-rate mortgages. In contrast, the Homeowner's Replacement Cost, which tracks home prices, continued to slow, pushing the CPI downwards. Month-over-month, on a seasonally-adjusted basis, prices were down 0.1 per cent in December. In BC, consumer prices rose 6.6 per cent year-over-year, down from 7.2 per cent last month.

While sharply declining gasoline prices were mostly responsible for the drop in CPI in December, there are encouraging signs that price appreciation is slowing in other sectors of the economy as well. Prices for household furnishings and equipment fell from last month amid ameliorating supply chain issues. The Bank of Canada's measures of core inflation, which strip out volatile components, ticked down in December for the first time since the summer. Weighing CPI numbers against a strong December jobs report, most analysts are expecting a final modest increase in rates on January 25th before the Bank concludes the tightening cycle.

The inventory of Townhomes on the market saw 5 sales in January, up one from the 4 that sold in the month of December, and down many from the 11 sold last January. Townhomes in the valley saw the average price for the 12 months to date ending in for January at $615,642, up a considerable 20% from $513,824 for the same period last year.

Canadian Inflation (December 2022) - January 17, 2023

Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.3 per cent on a year-over-year basis in December, a decrease from the 6.8 per cent rate in November. Falling gasoline (-13.1 per cent month on month) and fuel oil prices drove the decline, while softening costs for durable goods such as furniture and used vehicles also slowed price appreciation. Rising interest rates contributed to an increase in mortgage interest costs, which were up 18 per cent year-over-year as Canadians renewed or initiated higher-rate mortgages. In contrast, the Homeowner's Replacement Cost, which tracks home prices, continued to slow, pushing the CPI downwards. Month-over-month, on a seasonally-adjusted basis, prices were down 0.1 per cent in December. In BC, consumer prices rose 6.6 per cent year-over-year, down from 7.2 per cent last month.

While sharply declining gasoline prices were mostly responsible for the drop in CPI in December, there are encouraging signs that price appreciation is slowing in other sectors of the economy as well. Prices for household furnishings and equipment fell from last month amid ameliorating supply chain issues. The Bank of Canada's measures of core inflation, which strip out volatile components, ticked down in December for the first time since the summer. Weighing CPI numbers against a strong December jobs report, most analysts are expecting a final modest increase in rates on January 25th before the Bank concludes the tightening cycle.