We are certainly having an active spring market here in Cowichan Valley and Victoria. The market is not as active as the past few years, thou properly priced homes are selling. I’ve been involved in a handful of multiple offers in the past few weeks, and while not the norm, competing bids can occur on desirable homes. Generally, buyers have more homes to choose from so it's taking a little longer to sell.

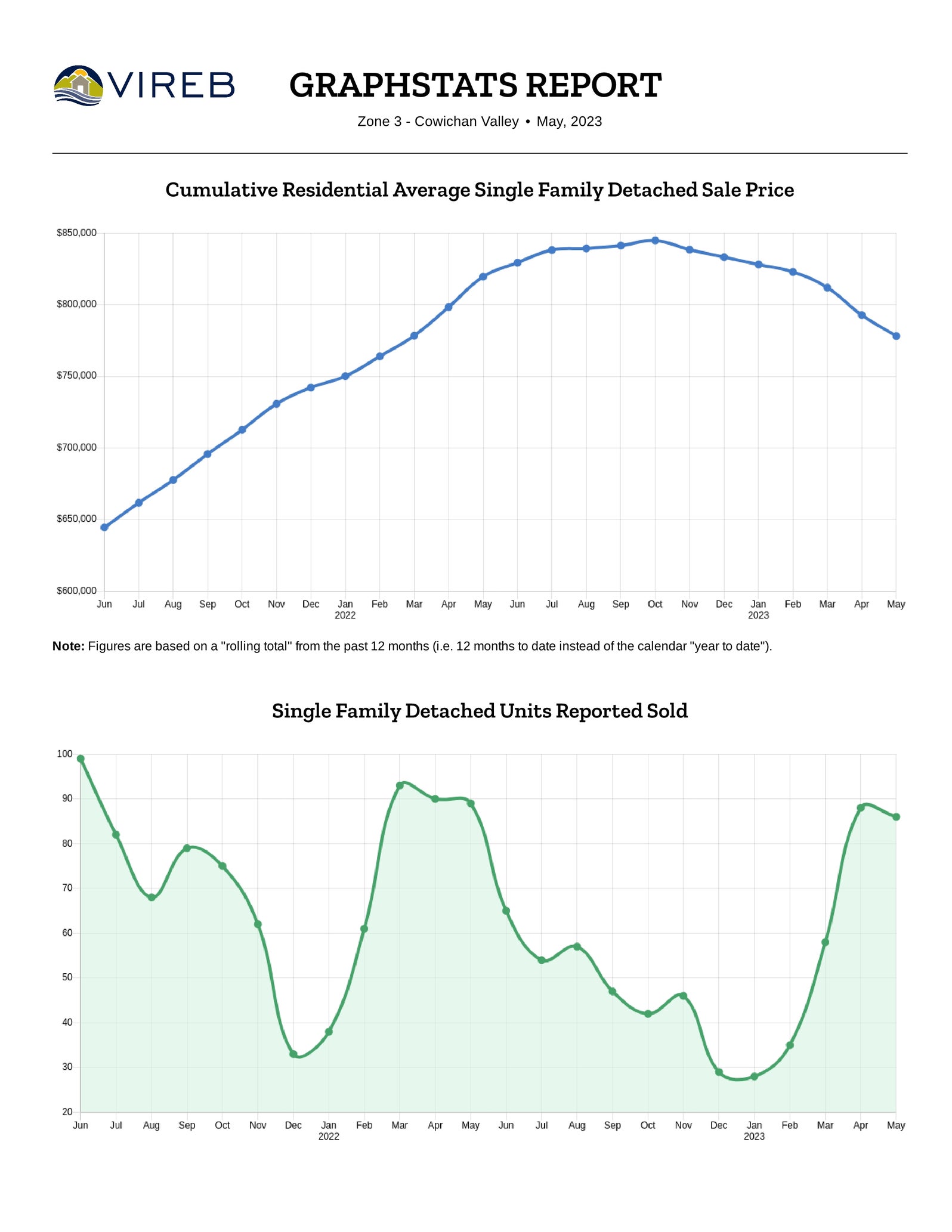

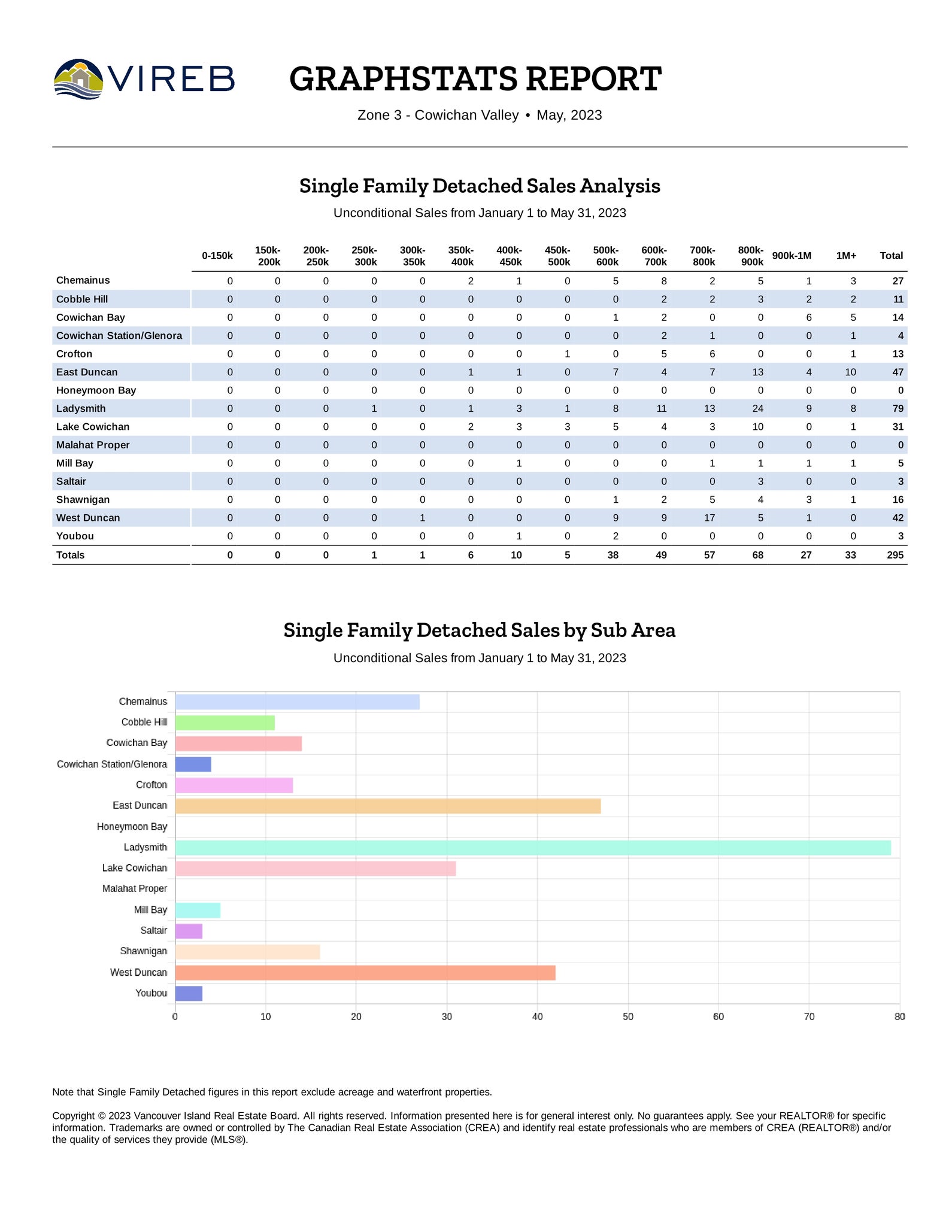

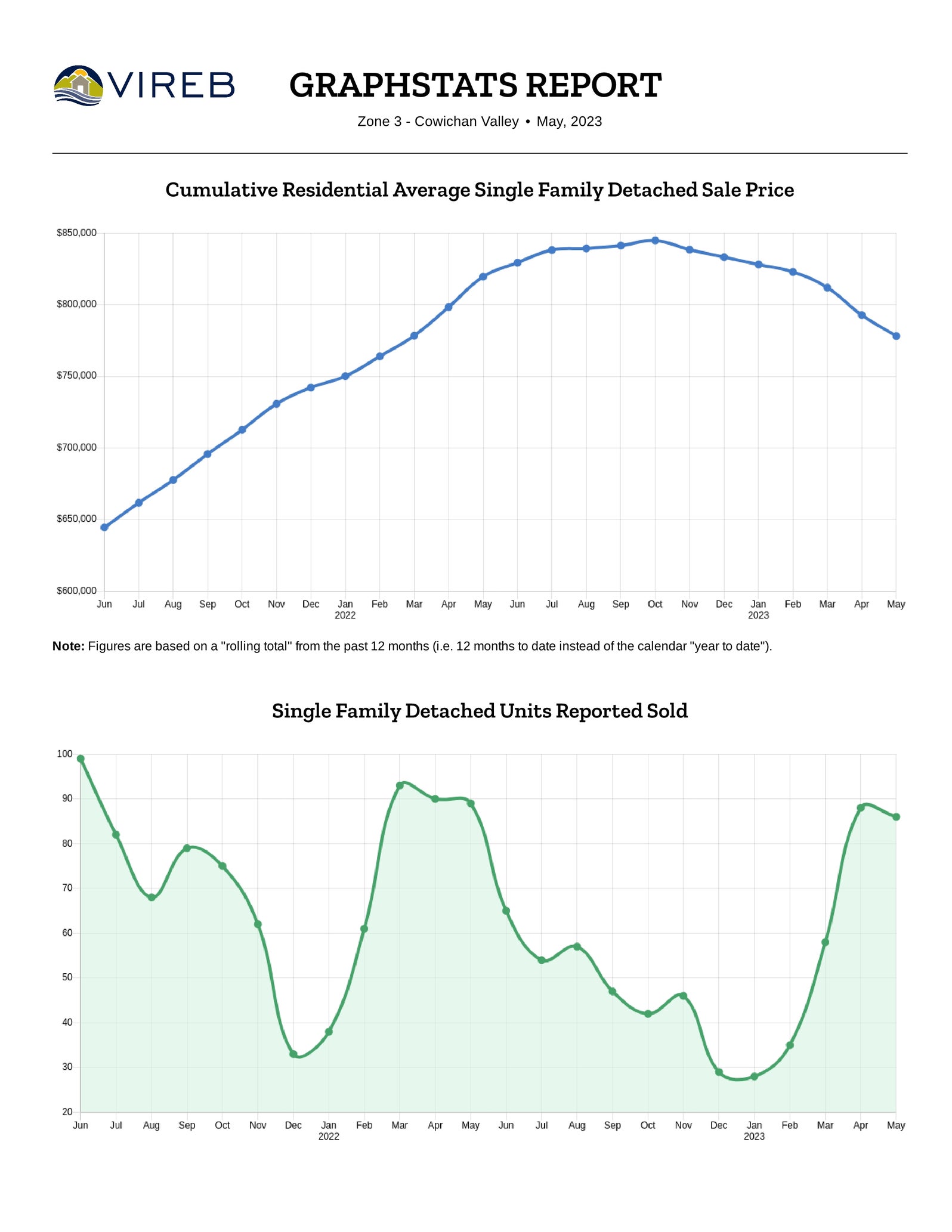

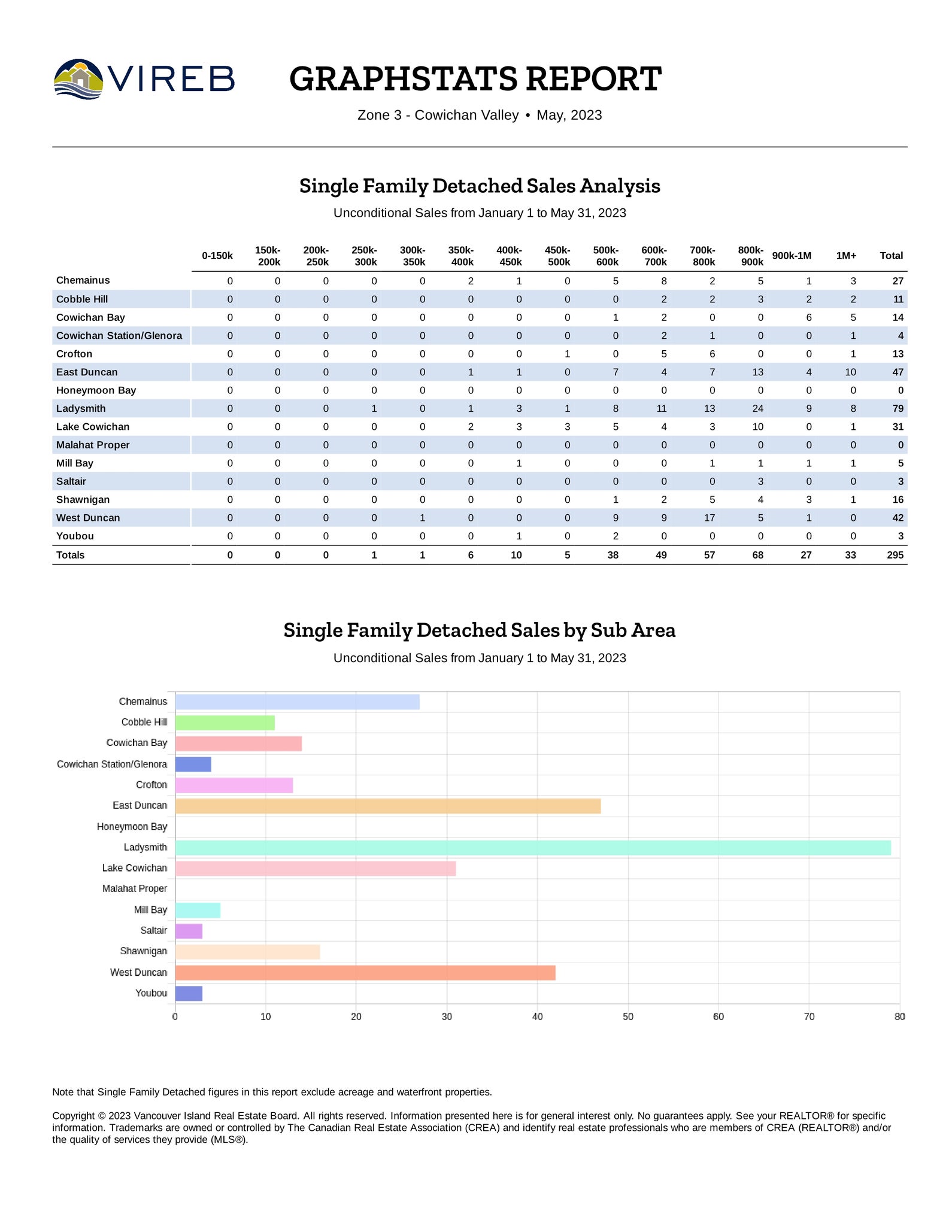

May saw a total of 86 single-family homes sold in the Cowichan Valley, down less than 1% from the 89 that sold in May of last year, and 2 fewer than the 88 homes sold in the preceding month of April. There were 145 single-family homes listed on the market in May 2023 compared to 146 last year, virtually no change. There were 635 sales in our valley over the past 12 months representing a 27% decrease in comparison to the 869 sales in the 12 months ending in May of last year.

Average prices for single-family residential homes in May 2023 were at $800,787, down about 15% from $904,676 in May 2022, and up from April’s average of $768,947. The median price of a single-family home in the Cowichan Valley for the 12 months to date ending in May 2023 was $765,000.

In May, the active inventory of single-family homes on the market in the Cowichan Valley was 387. When compared to the 269 homes at the end of May 2022, it gives home buyers more choice than last year.

Condominium apartment sales in May saw 9 units sold, up from 6 sales in the previous month of April, and equal to the 9 that sold last May. Condo apartments in the valley saw the average price for the 12 months ending in May 2022 at $348,268; that's up about 6% compared to last year.

The inventory of Townhomes on the market saw 17 sales in May, down from the 24 that sold in the month of April, and down from the 21 sold last May. Townhomes in the valley saw the average price for the 12 months to date ending in May at $574,596, almost equal to $574,411 for the same period last year.

Date: April 13, 2023

Distribution: Real estate licensees, real estate developers, mortgage brokers, credit unions, and interested parties

Advisory Number: 23-020

Purpose

The purpose of this Advisory is to notify regulated entities of the federal government's amendments, that came into force on March 27, 2023, to the accompanying Regulations of the Prohibition on the Purchase of Residential Property by Non-Canadians Act ("the Act").

Overview of Changes

The amendments to the accompanying Regulations broaden the exceptions that permit non-Canadians to purchase residential property under certain circumstances in order to make more non-Canadian families and businesses eligible to purchase residential property in Canada.

The amended Regulations include four key elements, summarized below.

Loosened Restrictions on Temporary Resident Work Permit Holders

The amendments allow foreign workers in Canada to purchase residential property if the following applies:

- They have a valid work permit or are authorized to work in Canada under the Immigration and Refugee Protection Regulations;

- Their work permits or work authorization are valid for at least 183 days or more at the time of purchase; and

- They have not purchased more than one residential property.

The amended Regulations also repeal the existing exceptions for foreign workers that allowed them to purchase property, as long as they filed all required tax returns and worked in Canada for a minimum period of three years.

Change to How Residential Property Is Defined

Vacant land zoned for residential and mixed use can now be purchased by non-Canadians and used for any purpose by the purchaser, including residential development.

New Exception to the Prohibition for Real Estate Development

The new exception will allow non-Canadians to purchase residential property for the purpose of development. This exception also extends to publicly traded entities formed under the laws of Canada or a province and controlled by a non-Canadian. For further information on what is meant by the term "development," please see Canada Mortgage and Housing Corporation's ("CMHC") frequently asked questions.

Increased Threshold Defining Foreign Control of Direct or Indirect Ownership

For prohibition purposes, the control threshold is now 10 per cent for privately held corporations or privately held entities formed under the laws of Canada or a province and controlled by a non-Canadian.

Considerations for Regulated Entities

Regulated entities should carefully review the Act and the amended Regulations to ensure they understand the scope and application of the prohibition. The recent amendments introduce several important exceptions that further define and clarify the Act's legal parameters. To ensure compliance with the Act, regulated entities should remain vigilant when dealing with clients or property that may fall under the Act's jurisdiction, and in cases of uncertainty, should recommend that clients seek legal advice before proceeding with any services.

Additional Information

To learn more about the amendments, please refer to:

The Prohibition on the Purchase of Residential Property by Non-Canadians Act;

The Prohibition of the Purchase of Residential Property by Non-Canadians Regulations;

CMHC's news release on the amendments; and

CMHC's updated frequently asked questions.

I'm happy to discuss our current market with you, please feel free to contact me.

May Sales Stats for Single Family Homes in the Cowichan Valley

May saw a total of 86 single-family homes sold in the Cowichan Valley, down less than 1% from the 89 that sold in May of last year, and 2 fewer than the 88 homes sold in the preceding month of April. There were 145 single-family homes listed on the market in May 2023 compared to 146 last year, virtually no change. There were 635 sales in our valley over the past 12 months representing a 27% decrease in comparison to the 869 sales in the 12 months ending in May of last year.

Average prices for single-family residential homes in May 2023 were at $800,787, down about 15% from $904,676 in May 2022, and up from April’s average of $768,947. The median price of a single-family home in the Cowichan Valley for the 12 months to date ending in May 2023 was $765,000.

In May, the active inventory of single-family homes on the market in the Cowichan Valley was 387. When compared to the 269 homes at the end of May 2022, it gives home buyers more choice than last year.

We had a 3.4-month supply of single-family homes on the market last month, while May 2022 had a 2.3-month supply. The average days to sell a single-family home in May was 28 days, compared to 15 days last May.

Condos & Townhouses

Condominium apartment sales in May saw 9 units sold, up from 6 sales in the previous month of April, and equal to the 9 that sold last May. Condo apartments in the valley saw the average price for the 12 months ending in May 2022 at $348,268; that's up about 6% compared to last year.

The inventory of Townhomes on the market saw 17 sales in May, down from the 24 that sold in the month of April, and down from the 21 sold last May. Townhomes in the valley saw the average price for the 12 months to date ending in May at $574,596, almost equal to $574,411 for the same period last year.

Amendments to the Prohibition on the Purchase of Residential Property by Non-Canadians Regulations

Date: April 13, 2023

Distribution: Real estate licensees, real estate developers, mortgage brokers, credit unions, and interested parties

Advisory Number: 23-020

Purpose

The purpose of this Advisory is to notify regulated entities of the federal government's amendments, that came into force on March 27, 2023, to the accompanying Regulations of the Prohibition on the Purchase of Residential Property by Non-Canadians Act ("the Act").

Overview of Changes

The amendments to the accompanying Regulations broaden the exceptions that permit non-Canadians to purchase residential property under certain circumstances in order to make more non-Canadian families and businesses eligible to purchase residential property in Canada.

The amended Regulations include four key elements, summarized below.

Loosened Restrictions on Temporary Resident Work Permit Holders

The amendments allow foreign workers in Canada to purchase residential property if the following applies:

- They have a valid work permit or are authorized to work in Canada under the Immigration and Refugee Protection Regulations;

- Their work permits or work authorization are valid for at least 183 days or more at the time of purchase; and

- They have not purchased more than one residential property.

The amended Regulations also repeal the existing exceptions for foreign workers that allowed them to purchase property, as long as they filed all required tax returns and worked in Canada for a minimum period of three years.

Change to How Residential Property Is Defined

Vacant land zoned for residential and mixed use can now be purchased by non-Canadians and used for any purpose by the purchaser, including residential development.

New Exception to the Prohibition for Real Estate Development

The new exception will allow non-Canadians to purchase residential property for the purpose of development. This exception also extends to publicly traded entities formed under the laws of Canada or a province and controlled by a non-Canadian. For further information on what is meant by the term "development," please see Canada Mortgage and Housing Corporation's ("CMHC") frequently asked questions.

Increased Threshold Defining Foreign Control of Direct or Indirect Ownership

For prohibition purposes, the control threshold is now 10 per cent for privately held corporations or privately held entities formed under the laws of Canada or a province and controlled by a non-Canadian.

Considerations for Regulated Entities

Regulated entities should carefully review the Act and the amended Regulations to ensure they understand the scope and application of the prohibition. The recent amendments introduce several important exceptions that further define and clarify the Act's legal parameters. To ensure compliance with the Act, regulated entities should remain vigilant when dealing with clients or property that may fall under the Act's jurisdiction, and in cases of uncertainty, should recommend that clients seek legal advice before proceeding with any services.

Additional Information

To learn more about the amendments, please refer to:

The Prohibition on the Purchase of Residential Property by Non-Canadians Act;

The Prohibition of the Purchase of Residential Property by Non-Canadians Regulations;

CMHC's news release on the amendments; and

CMHC's updated frequently asked questions.