As February begins, we enter an important period in the real estate market, a time of significant activity in the market. February is the precursor to the bustling spring months of March through June. Already, I've witnessed a notable uptick in both listing and showing activity, a trend projected to persist in the foreseeable future.

If you're contemplating a real estate decision, seize the opportunity to connect with me to ensure listing during what is arguably the best time of year. Whether you're considering buying, selling, or simply seeking guidance, I'm here to lend a helping hand. Feel free to reach out to me personally at your convenience, for any inquiries or assistance you may require.

Warm regards, Paul

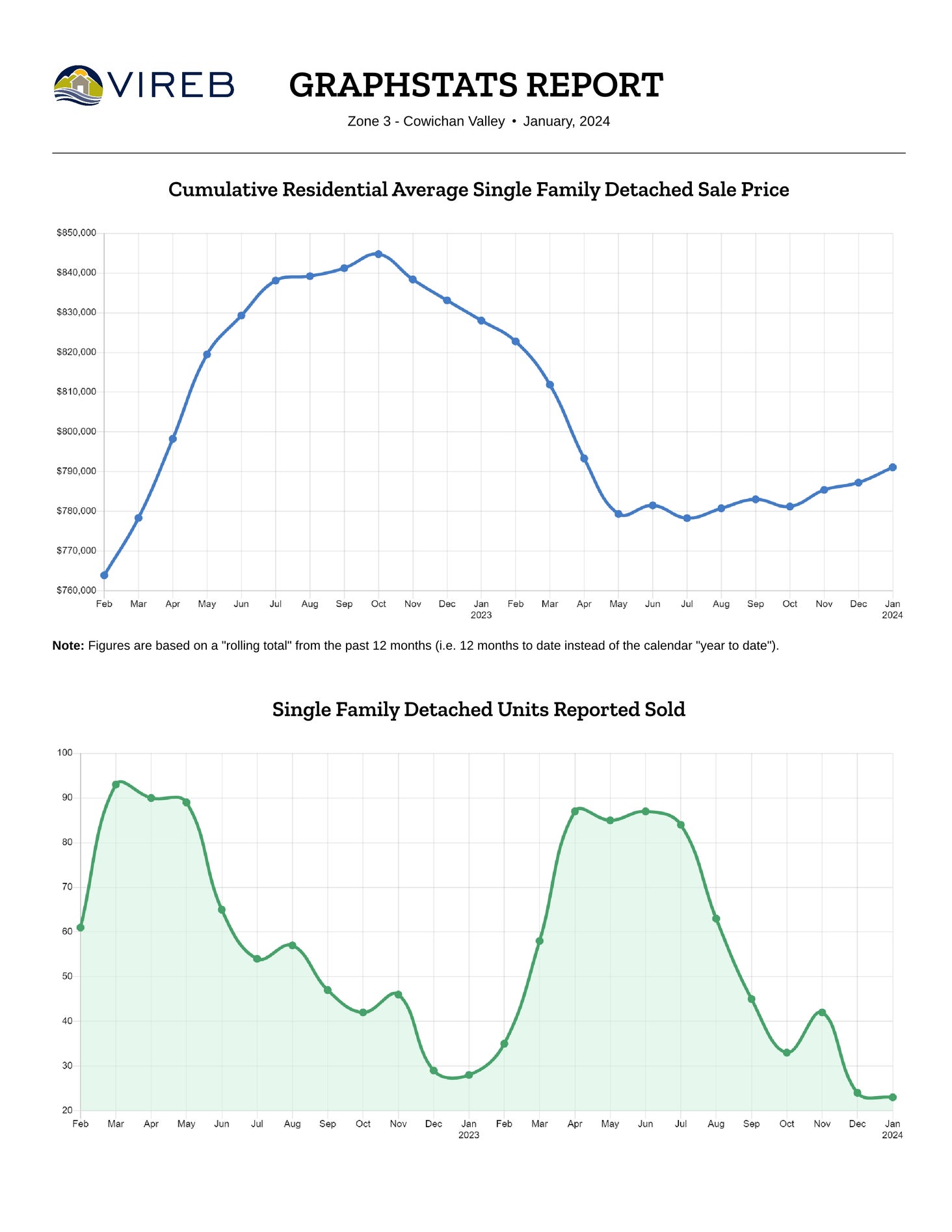

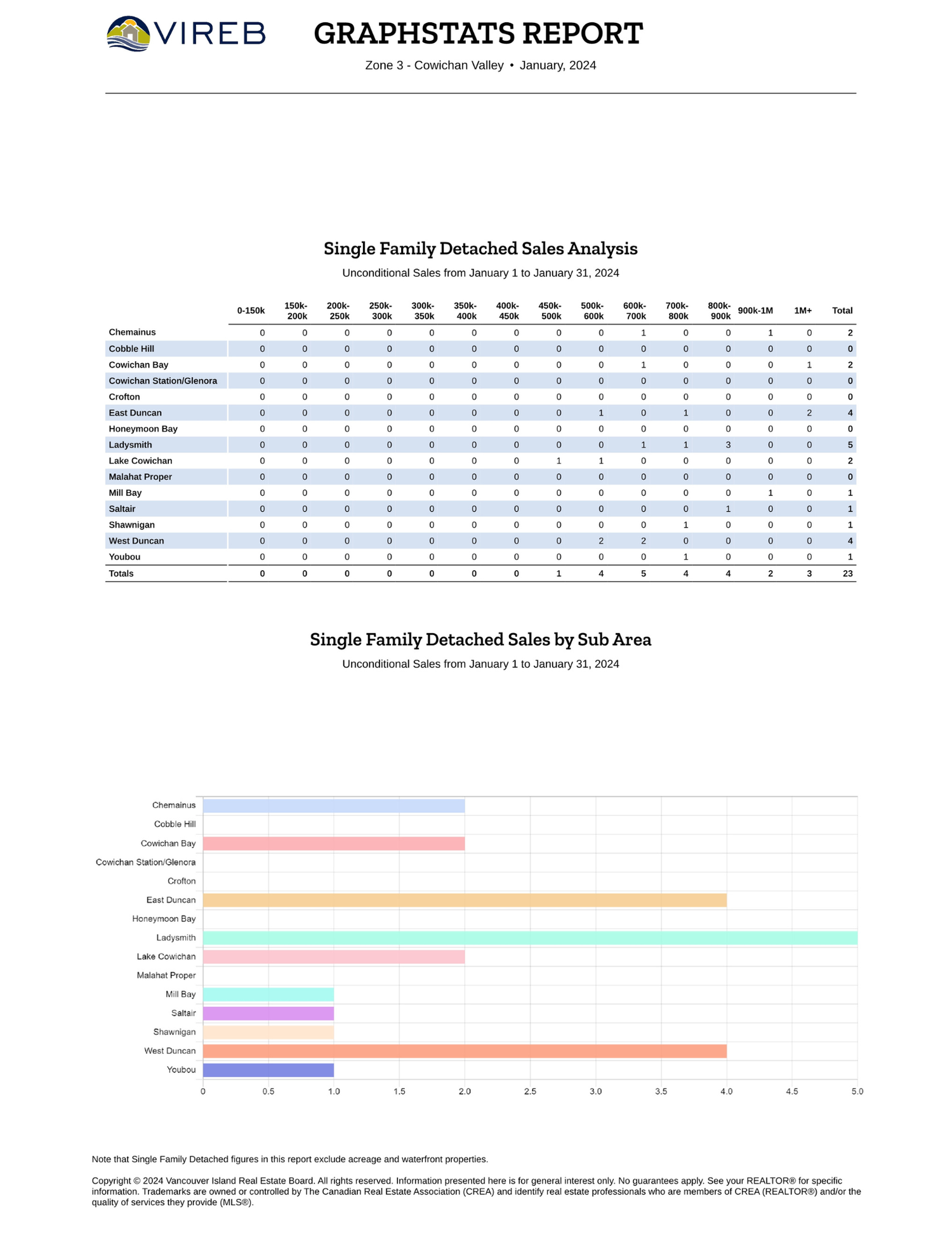

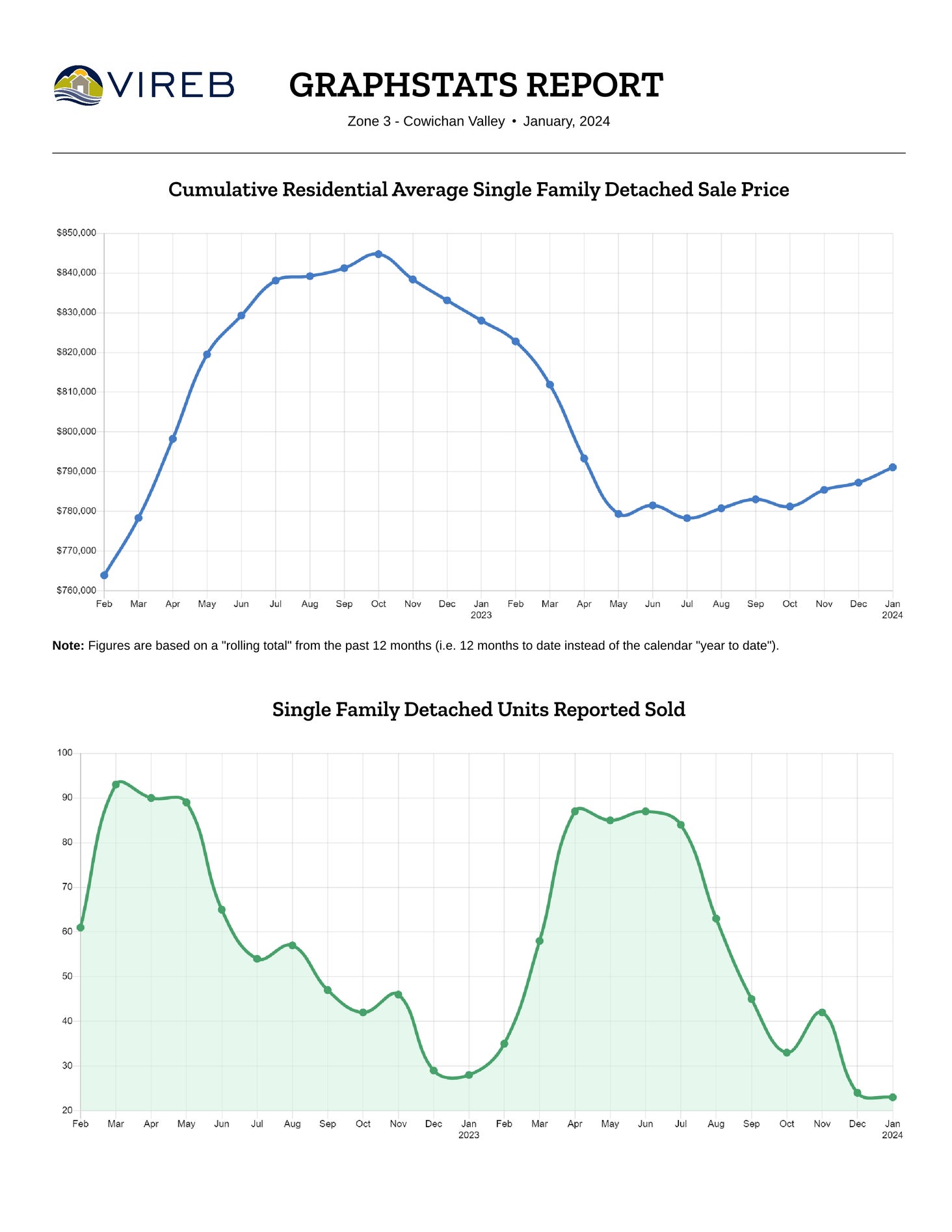

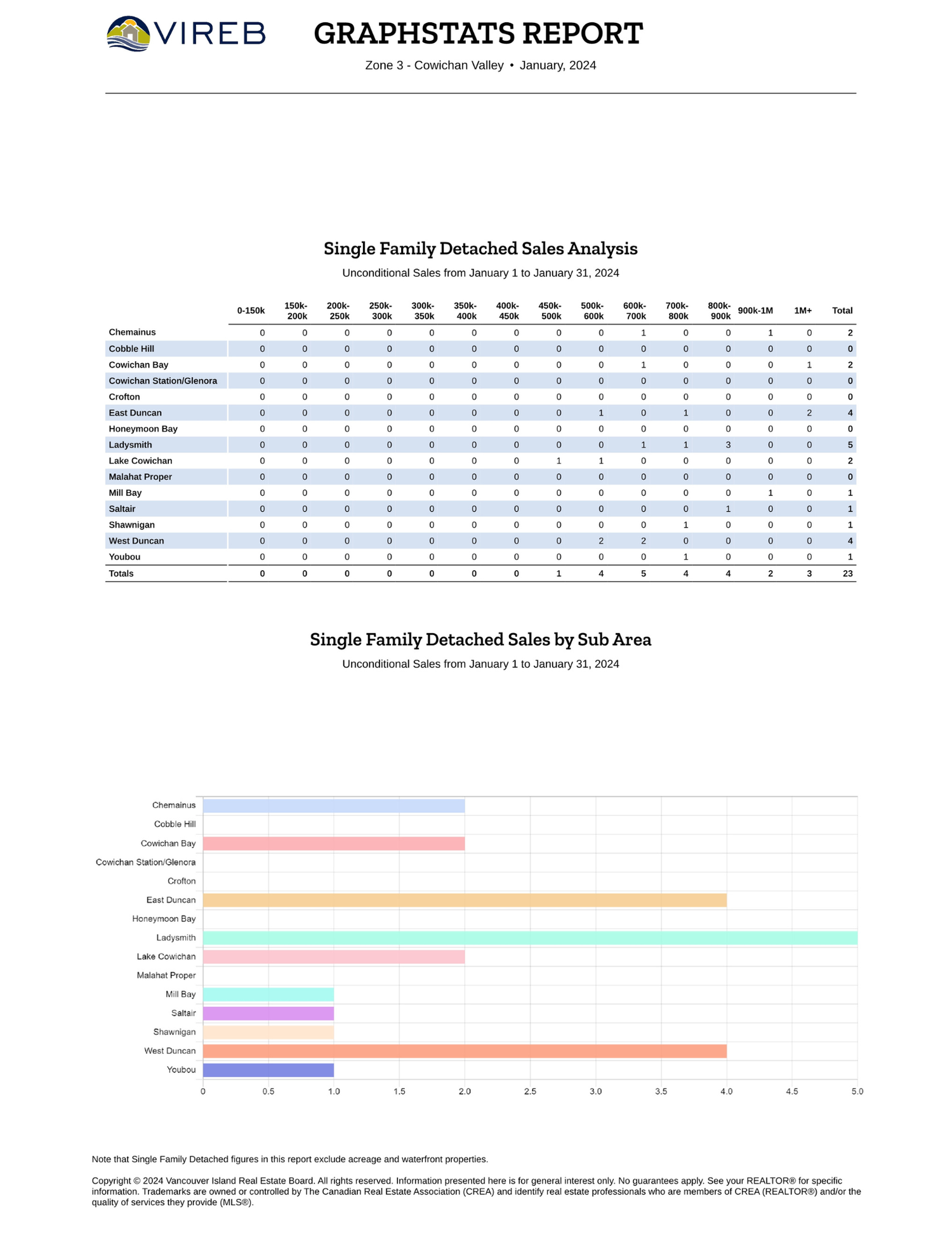

January saw a total of 23 single-family homes sold in the Cowichan Valley, down from the 28 that sold in January of last year, and down from the 26 in the preceding month of December. There were 70 single-family homes listed on the market in January 2024 compared to 66 last year, up about 6%. There were 666 sales in our valley over the past 12 months representing a 12% decrease in comparison to the 701 sales in the 12 months ending in January of last year.

Average prices for single-family residential homes in January 2024 were at $773,230, up about 13% from $683,863 in January 2023, and up slightly from December’s average of $772,611. The median price of a single-family home in the Cowichan Valley for the 12 months to date ending in January 2024 was $775,000.

In January, the active inventory of single-family homes on the market in the Cowichan Valley was 283, up from the 256 homes at the end of January 2023.

Condominium apartment sales in January saw 3 units sold, down from 7 sales in the previous month of December, and down 6 units from the 9 that sold last January. Condo apartments in the valley saw the average price for the 12 months ending in January 2024 at $332,849, down 7% for the same period as last year, $358,120.

The inventory of Townhomes on the market saw 13 sales in January, up from the 8 that sold in the month of December, and up considerably from the 5 sold last January, a 160% increase. Townhomes in the valley saw the average price for the 12 months to date ending in January at $565,019, down 8% from $615,642 for the same period last year.

By Fergal McAlinden

19 Jan. 2024

The Bank of Canada is likely to leave its overnight rate unchanged in its first decision of 2024, according to new forward guidance by the Royal Bank of Canada (RBC).

The central bank is set to make its opening rate announcement of the year next Wednesday (January 24), with little indication that it will diverge from a course that’s seen the policy rate – which leads variable interest rates in Canada – remain unchanged for three consecutive decisions.

RBC assistant chief economist Nathan Janzen and economist Claire Fan said in a Friday note that while observers would be closely watching for hints on a timeline for possible rate cuts, the central bank was likely to pour cold water on the prospect of an imminent shift to lower rates.

“There is some potential that the central bank could hint at an earlier-than-expected end to quantitative tightening policy but would likely take pains to communicate the primary objective of that change would be to ensure adequate liquidity in funding markets rather than flagging a shift to easier monetary policy and imminent rate cuts,” the economists wrote.

The Bank has hiked its benchmark rate by a total of 475 basis points since March 2022, taking an aggressive stance in the face of inflation that surged to a 39-year high of 8.1% in the summer of that year.

The consumer price index (CPI) has ticked down substantially since that June 2022 peak, although Janzen and Fan noted that stickier-than-expected recent inflation and wage growth probably indicate it’s too early for the central bank to consider easing rates at present.

“Consumer prices rose 3.2% year over year in Q4, slightly below the 3.3% increase that was last projected by the central bank in October,” they said.

“But the details in the December inflation report – including a reacceleration in the closely-watched three-month average increase in the BoC’s preferred core measures to the 3.5% to 4% range – was a reminder that inflation is not yet fully back under control.”

Inflation will still probably trend lower in the coming months, Janzen and Fan added, with mortgage interest costs currently accounting for a “disproportionate” share of overall price growth.

A softening economic landscape marked by lower consumer demand and per-capita GDP – as well as a jump in unemployment – suggest inflation will continue to trend lower.

Still, “the BoC will be cautious about declaring victory over inflation too soon,” Janzen and Fan said. “We expect the first decrease in the overnight rate to come around the middle of this year, and for that to be followed by 75 bps [basis points] more later in the year to lower the overnight rate to 4% by the end of 2024.”

If you're contemplating a real estate decision, seize the opportunity to connect with me to ensure listing during what is arguably the best time of year. Whether you're considering buying, selling, or simply seeking guidance, I'm here to lend a helping hand. Feel free to reach out to me personally at your convenience, for any inquiries or assistance you may require.

Warm regards, Paul

January 2024 Cowichan Valley Single Family Detached Home Statistics

January saw a total of 23 single-family homes sold in the Cowichan Valley, down from the 28 that sold in January of last year, and down from the 26 in the preceding month of December. There were 70 single-family homes listed on the market in January 2024 compared to 66 last year, up about 6%. There were 666 sales in our valley over the past 12 months representing a 12% decrease in comparison to the 701 sales in the 12 months ending in January of last year.

Average prices for single-family residential homes in January 2024 were at $773,230, up about 13% from $683,863 in January 2023, and up slightly from December’s average of $772,611. The median price of a single-family home in the Cowichan Valley for the 12 months to date ending in January 2024 was $775,000.

In January, the active inventory of single-family homes on the market in the Cowichan Valley was 283, up from the 256 homes at the end of January 2023.

We had a 9.4-month supply of single-family homes on the market last month, while January 2023 had a 6.7-month supply. The average days to sell a single-family home in January was 47 days, down from 65 days last January.

Condos & Townhouses

Condominium apartment sales in January saw 3 units sold, down from 7 sales in the previous month of December, and down 6 units from the 9 that sold last January. Condo apartments in the valley saw the average price for the 12 months ending in January 2024 at $332,849, down 7% for the same period as last year, $358,120.

The inventory of Townhomes on the market saw 13 sales in January, up from the 8 that sold in the month of December, and up considerably from the 5 sold last January, a 160% increase. Townhomes in the valley saw the average price for the 12 months to date ending in January at $565,019, down 8% from $615,642 for the same period last year.

BoC set to leave rate unchanged in January, says RBC

The central bank's first rate decision of 2024 arrives this week

By Fergal McAlinden

19 Jan. 2024

The Bank of Canada is likely to leave its overnight rate unchanged in its first decision of 2024, according to new forward guidance by the Royal Bank of Canada (RBC).

The central bank is set to make its opening rate announcement of the year next Wednesday (January 24), with little indication that it will diverge from a course that’s seen the policy rate – which leads variable interest rates in Canada – remain unchanged for three consecutive decisions.

RBC assistant chief economist Nathan Janzen and economist Claire Fan said in a Friday note that while observers would be closely watching for hints on a timeline for possible rate cuts, the central bank was likely to pour cold water on the prospect of an imminent shift to lower rates.

“There is some potential that the central bank could hint at an earlier-than-expected end to quantitative tightening policy but would likely take pains to communicate the primary objective of that change would be to ensure adequate liquidity in funding markets rather than flagging a shift to easier monetary policy and imminent rate cuts,” the economists wrote.

The Bank has hiked its benchmark rate by a total of 475 basis points since March 2022, taking an aggressive stance in the face of inflation that surged to a 39-year high of 8.1% in the summer of that year.

The consumer price index (CPI) has ticked down substantially since that June 2022 peak, although Janzen and Fan noted that stickier-than-expected recent inflation and wage growth probably indicate it’s too early for the central bank to consider easing rates at present.

“Consumer prices rose 3.2% year over year in Q4, slightly below the 3.3% increase that was last projected by the central bank in October,” they said.

“But the details in the December inflation report – including a reacceleration in the closely-watched three-month average increase in the BoC’s preferred core measures to the 3.5% to 4% range – was a reminder that inflation is not yet fully back under control.”

Inflation will still probably trend lower in the coming months, Janzen and Fan added, with mortgage interest costs currently accounting for a “disproportionate” share of overall price growth.

A softening economic landscape marked by lower consumer demand and per-capita GDP – as well as a jump in unemployment – suggest inflation will continue to trend lower.

Still, “the BoC will be cautious about declaring victory over inflation too soon,” Janzen and Fan said. “We expect the first decrease in the overnight rate to come around the middle of this year, and for that to be followed by 75 bps [basis points] more later in the year to lower the overnight rate to 4% by the end of 2024.”