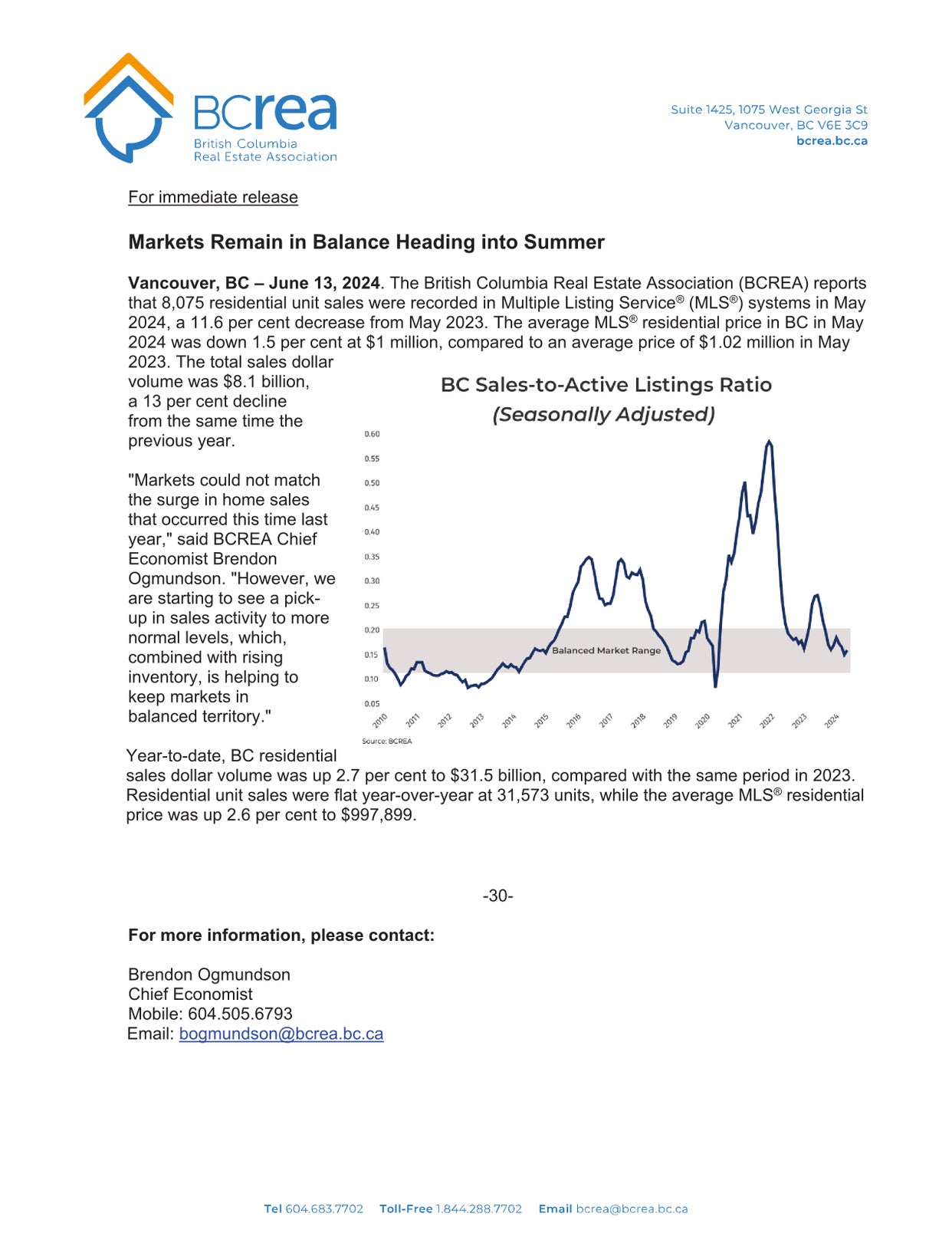

I hope this finds you all well and enjoying the summer! There is a lot happening in real estate right now. Depending on the price point of a specific home, we are fluctuating between a balanced market and a buyer’s market. While British Columbia is in a balanced market, with just over 7 months of home inventory for sale in June, the Cowichan Valley is considered a buyer’s market. This is creating downward pressure on pricing, and many sellers are experiencing extended periods to sell a home as buyers have a lot more options to consider before deciding to buy.

Landlords, be sure to read up on the new rules as there are a few unprecedented changes coming into effect this month. There's a lot of information to absorb!

For further details and insights, feel free to contact me!

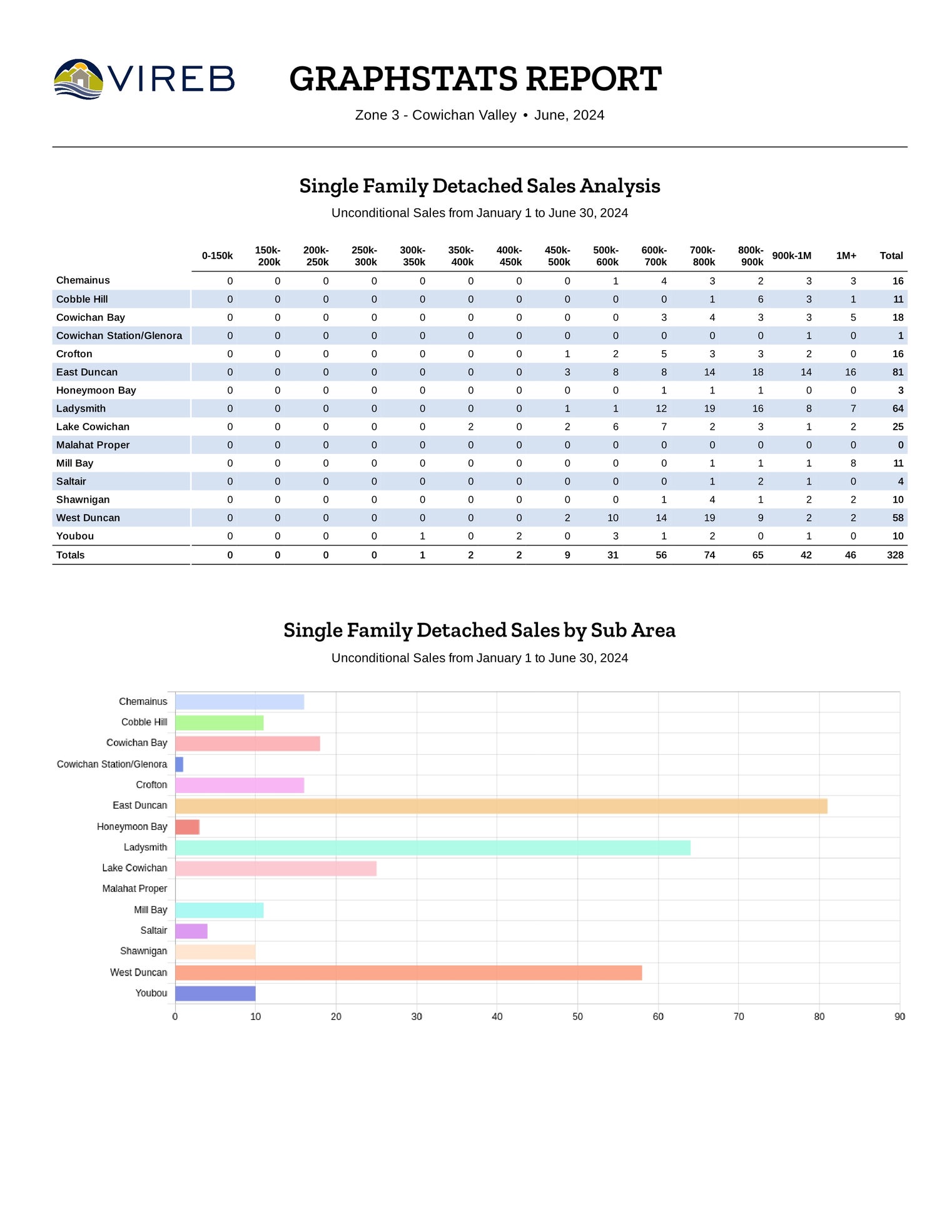

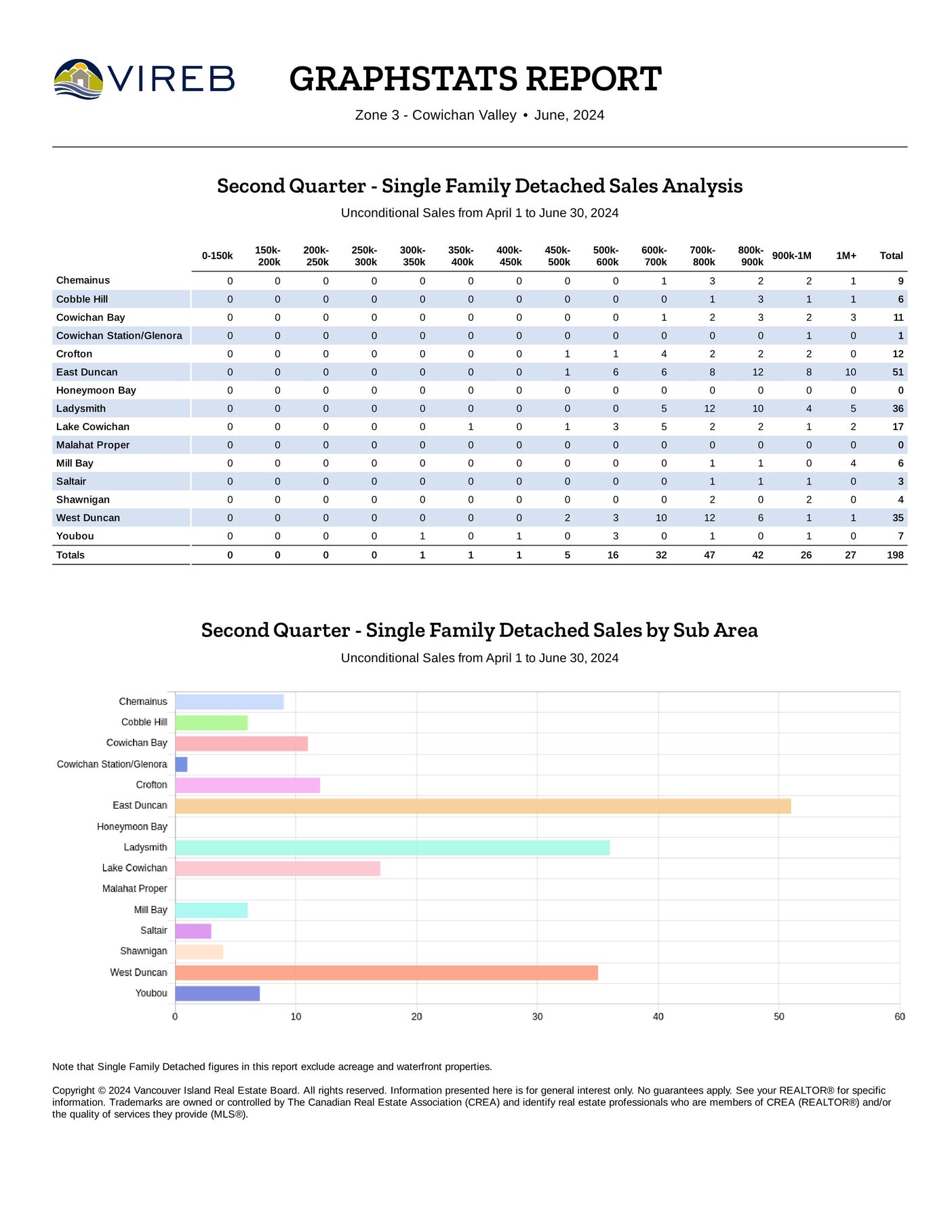

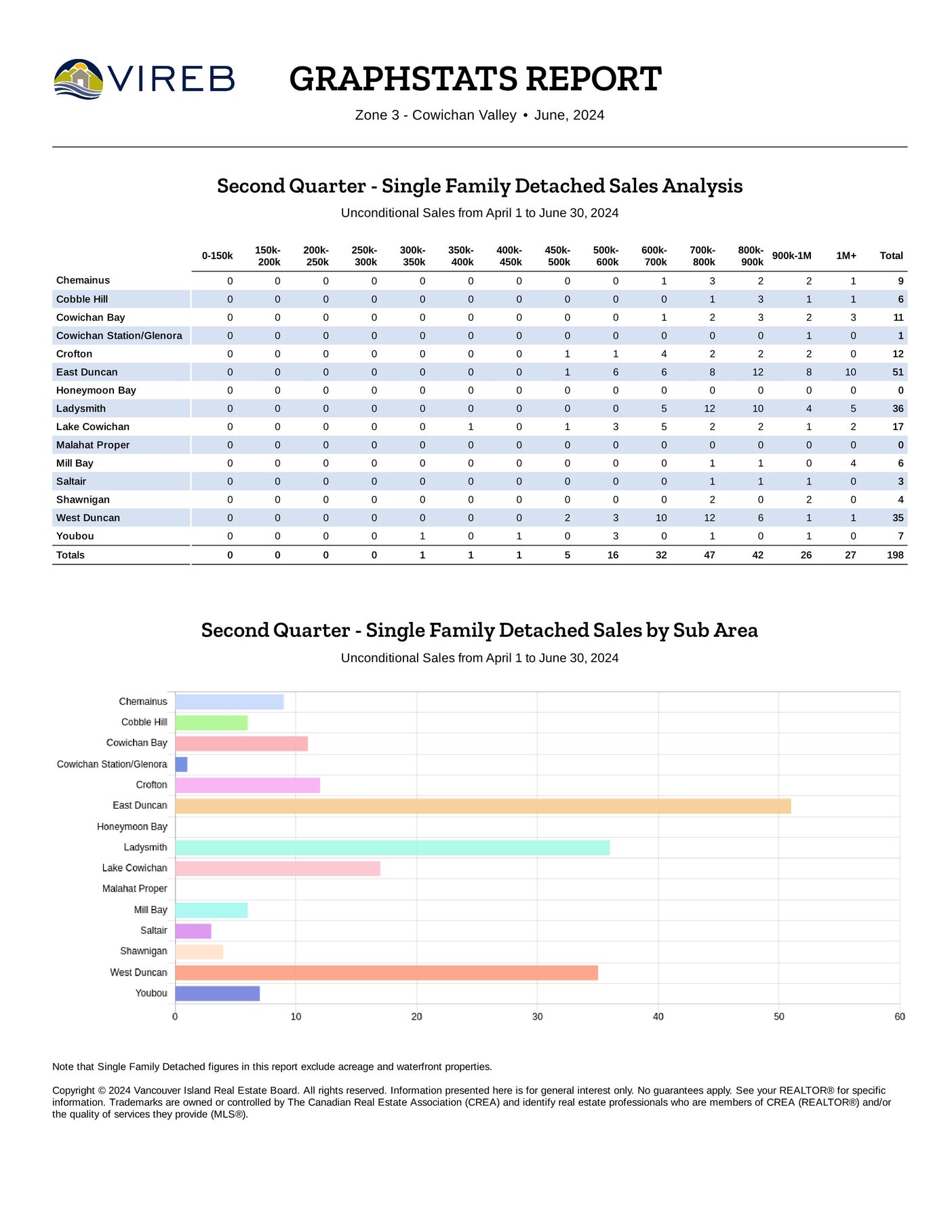

June 2024 Statistics for Single Family Dwellings in the Cowichan Valley

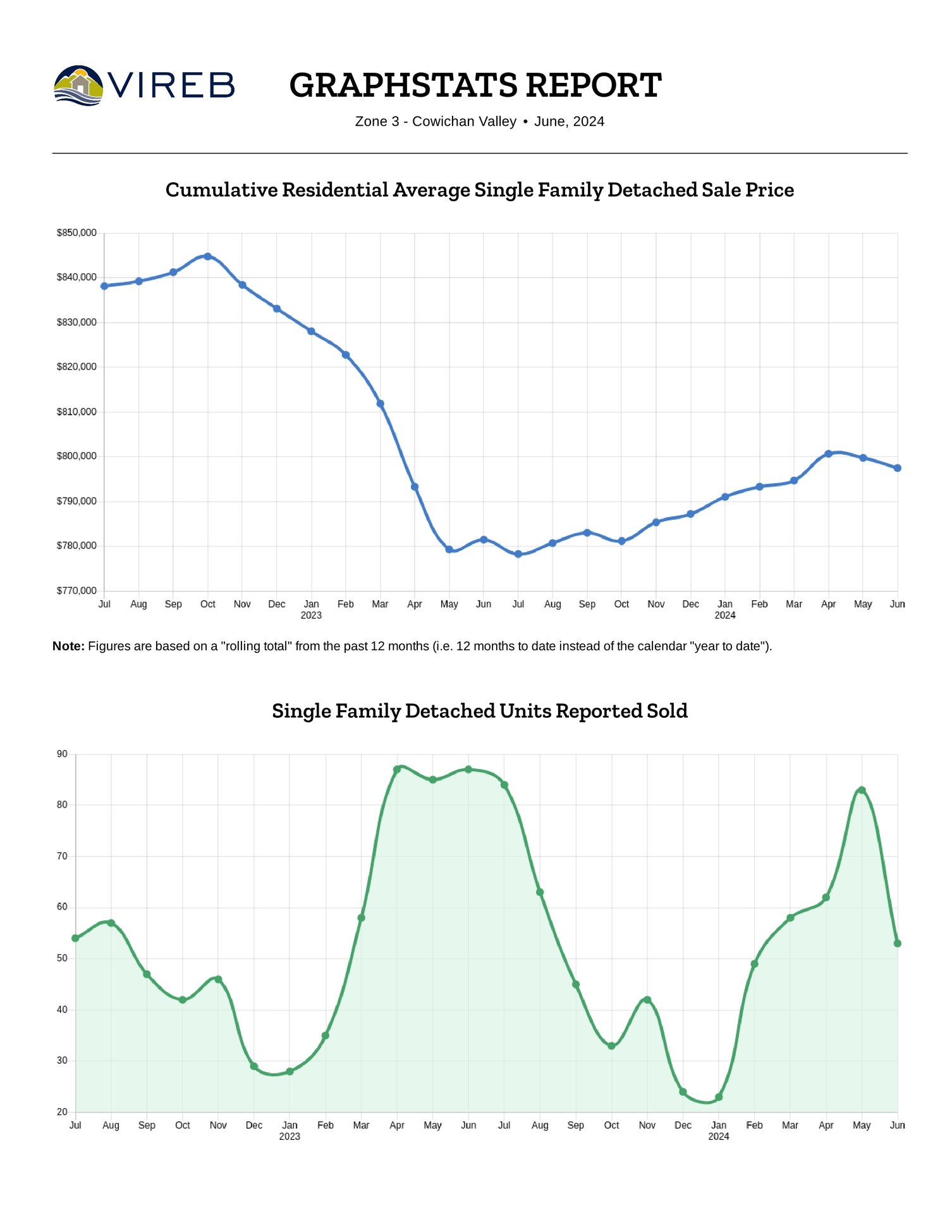

June saw a total of 53 single-family homes sold in the Cowichan Valley, a significant decrease from the 87 sold in June of last year and down from the 83 sold in May. There were 145 single-family homes listed on the market in June 2024, a slight 2% decrease from the 148 listed last year. Over the past 12 months, there were 1,190 sales in our valley, representing a 1% decrease compared to the 1,198 sales in the 12 months ending in June of last year. The average selling price of a home over the past 12 months increased by 2%.

The average price for single-family residential homes in June 2024 was $789,016, down about 3% from $809,733 in June 2023 and from May’s average of $799,090. The median price of a single-family home in the Cowichan Valley for the 12 months ending in June 2024 was $784,000.

In June, the active inventory of single-family homes on the market in the Cowichan Valley was 321, up from 224 homes at the end of June 2023.

We had a 7.1-month supply of single-family homes on the market last month, compared to a 3.5-month supply in June 2023. The average days to sell a single-family home in June was 42 days, down from 45 days last June.

Condos and Townhouse

Condominium apartment sales in June saw 7 units sold, down from 12 sales in the previous month of May, and down about half from the 15 units that sold last June. Condo apartments in the valley saw the average price for the 12 months ending in June 2024 at $336,357, up 6.5% for the same period as last year, $315,973.

The inventory of Townhomes on the market saw 11 sales in June, almost half from the 21 that sold in the month of May, and down from the 24 sold last June, a 54% decrease. Townhomes in the valley saw the average price for the 12 months to date ending in June at $565,395, down just 0.6% from $568,796 for the same period last year.

If you would like to see my current listings, please click here.

Landlords Take Notice – Recent Amendments to BC Tenancy Legislation #574

by Amy Peck

The BC residential rental market has been a very hot topic lately in many different business and social circles. Restrictions imposed on the short-term rental market have taken several homeowners by surprise, and the BC Government has again changed the rental landscape with the passing of Bill 14 – Tenancy Statutes Amendment Act, 2024, which amends the BC Residential Tenancy Act (RTA) and the BC Manufactured Home Park Tenancy Act. Bill 14 was granted royal assent and became law on May 16, 2024, and the changes will take effect in phases. This article focuses on the changes to the RTA.

For the full article and details of the changes, please click here.

From BCREA July 8, 2024 - Key Changes Effective July 18, 2024

Mandatory Use of Landlord Use of New Web Portal:

> Landlords must use this portal to generate Notices to End Tenancy for personal or caretaker use.

> Landlords using the website portal will be required to have a Basic BCeID to access the site. LINK here

> The portal will require landlords to provide details about the persons moving into the home. The details of the new occupant of the home will be shared with the tenant.

> While using the website portal, landlords will be given information about the required conditions for ending a tenancy and the penalties associated with ending the tenancy in bad faith.

> They will also be informed about the amount of compensation they will be required to issue to tenants when ending a tenancy.

Extended Notice Period:

> The Two-Month Notice is changing to a Four-Month Notice on July 18, 2024.

> Tenants will have 30 days to dispute Notices to End Tenancy, extended from 15 days.

Occupancy Requirements:

> The individual moving into the property must occupy it for at least 12 months.

> Landlords found to be ending a tenancy in bad faith could be ordered to pay the displaced tenant 12 months' rent.

Website launched to protect renters from bad-faith evictions

Updated on July 3, 2024

A new website launching on July 18, 2024, will better protect renters from being evicted in bad faith and bring improvements to the process for landlords.

“With this new tool, we’re taking action to better protect tenants from being evicted under false pretences and ensure that landlords who need to legitimately reclaim their units have a straightforward pathway to do so,” said Ravi Kahlon, Minister of Housing. “The portal will also provide government with a window to better understand when and how often these evictions occur so that we can continue to build on our work to improve services for renters and landlords.”

“With this new tool, we’re taking action to better protect tenants from being evicted under false pretences and ensure that landlords who need to legitimately reclaim their units have a straightforward pathway to do so,” said Ravi Kahlon, Minister of Housing. “The portal will also provide government with a window to better understand when and how often these evictions occur so that we can continue to build on our work to improve services for renters and landlords.”

To read more, please click here.

Controversial capital gains change now in effect

By Annie Bergeron-Oliver

A controversial increase to the capital gains inclusion rate is now in effect despite strong pushback from small businesses, farmers and medical professionals.

Starting Tuesday, individuals with capital gains of more than $250,000 will be subject to an inclusion rate of 67 per cent, up from 50 per cent before. For corporations, all capital gains are now subject to the two-thirds inclusion rate.

The federal government says the move will improve tax fairness and increase federal revenues(opens in a new tab) by $19.4 billion over five years, with a bulk of that money flowing into federal coffers this year. Budget 2024 shows the change to the inclusion rate will bring in an estimated $6.9 billion dollars this fiscal year.

The tax change applies to profits made from the sale of secondary properties or investments, including stocks or bonds and family cottages. The new inclusion rate does not change the tax rate itself, which will continue to be an individual or corporation's marginal rate, but increases the taxable portion of that gain.

"Do you want to live in a country where we make the investments we need — in health care, in housing, in old age pensions — but we lack the political will to pay for them, and choose instead to pass a ballooning debt onto our children?" Finance Minister and Deputy Prime Minister Chrystia Freeland asked in Toronto earlier this month.

For the full article including the video, please click here.