May Market Update: Single-Family Homes in the South Island

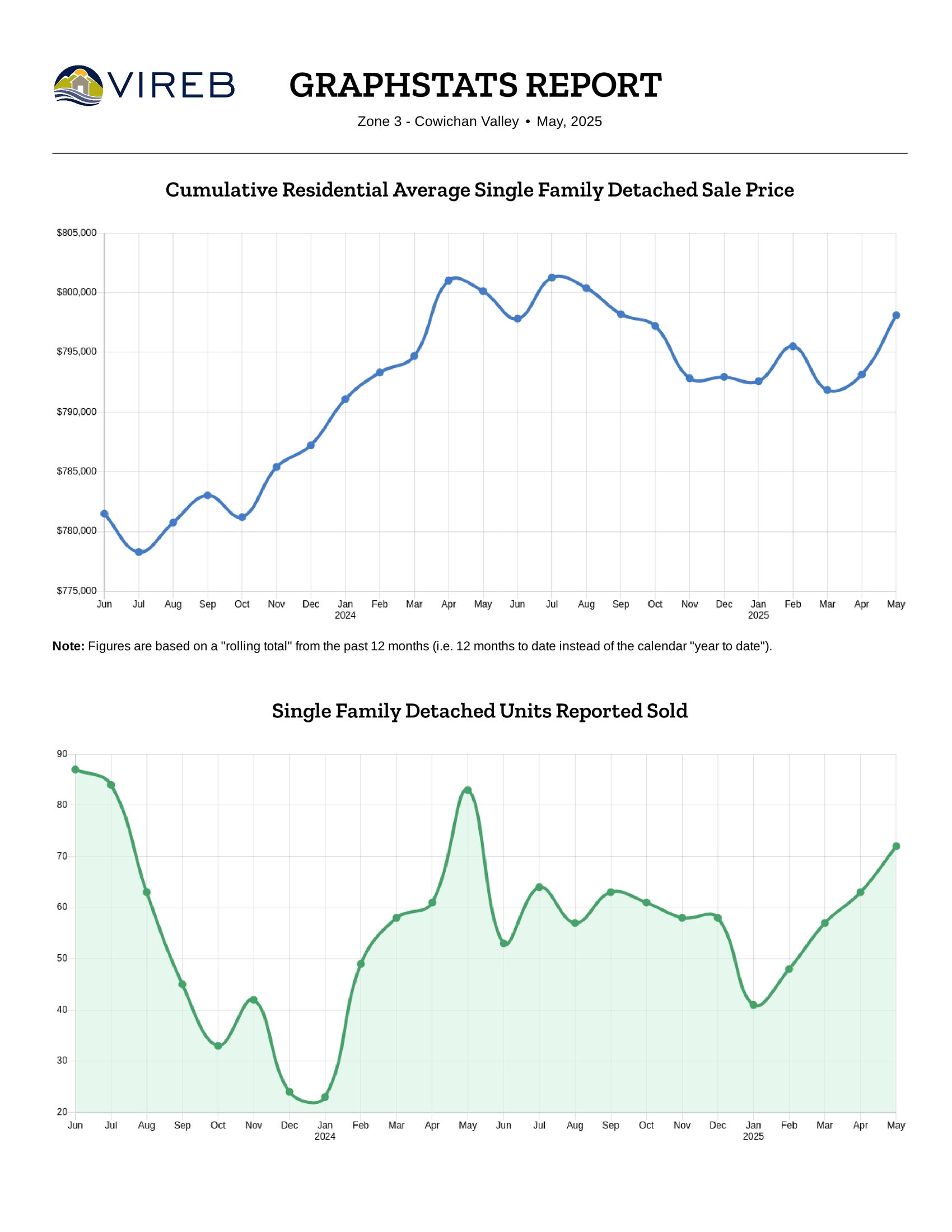

COWICHAN VALLEY

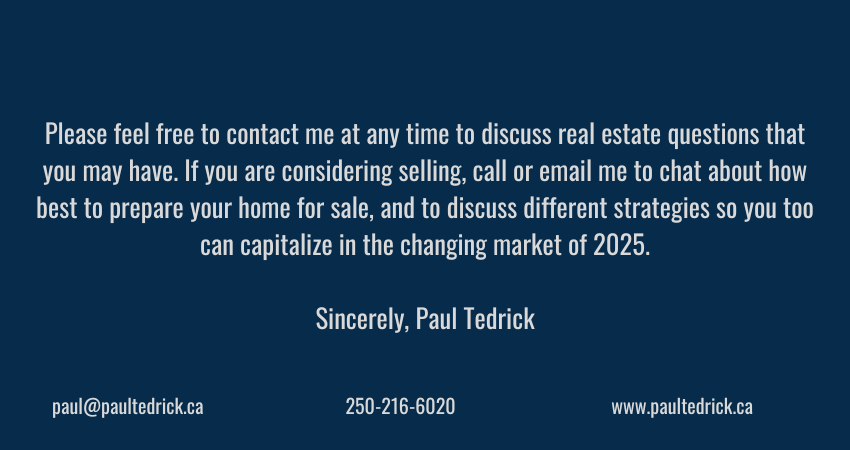

Summary: As of May 2025, the average sale price for single-family homes was $847,983, with a sell-to-list ratio of 50%, indicating a competitive market.

Sales Activity: A total of 72 single-family homes were sold in the Cowichan Valley during May 2025, marking a notable decrease from 83 homes sold in May 2024 and up from 63 homes in April 2025.

Listings & Inventory: The market saw 148 new single-family home listings in May, virtually unchanged from 147 listings in May of last year. As of the end of May, 289 homes were actively listed, up slightly from 283 homes available at the same time last year.

Pricing Trends:

• The average sale price in May 2025 was $847,983, up 6% from May 2024’s average of $799,090.

• Compared to April 2025’s average of $845,292, prices have remained consistent.

• For the 12-month period ending in May 2025, the median sale price stood at $777,000.

Annual Performance: Over the past 12 months, 695 single-family homes were sold, which represents a 6% incline compared to the 652 sales in the same period ending in May 2024. The average selling price for the year is down just 0.25%.

Market Supply & Days on Market:

• The supply of homes decreased to 5.0 months in May 2025, up from 4.8 months in May 2024.

• Homes sold in May took an average of 49 days to sell, compared to 41 days in May last year.

This summary highlights the key market trends and performance for single-family homes in the Cowichan Valley, helping homeowners and buyers stay informed about the latest developments. Feel free to reach out for further details or if you need personalized advice!

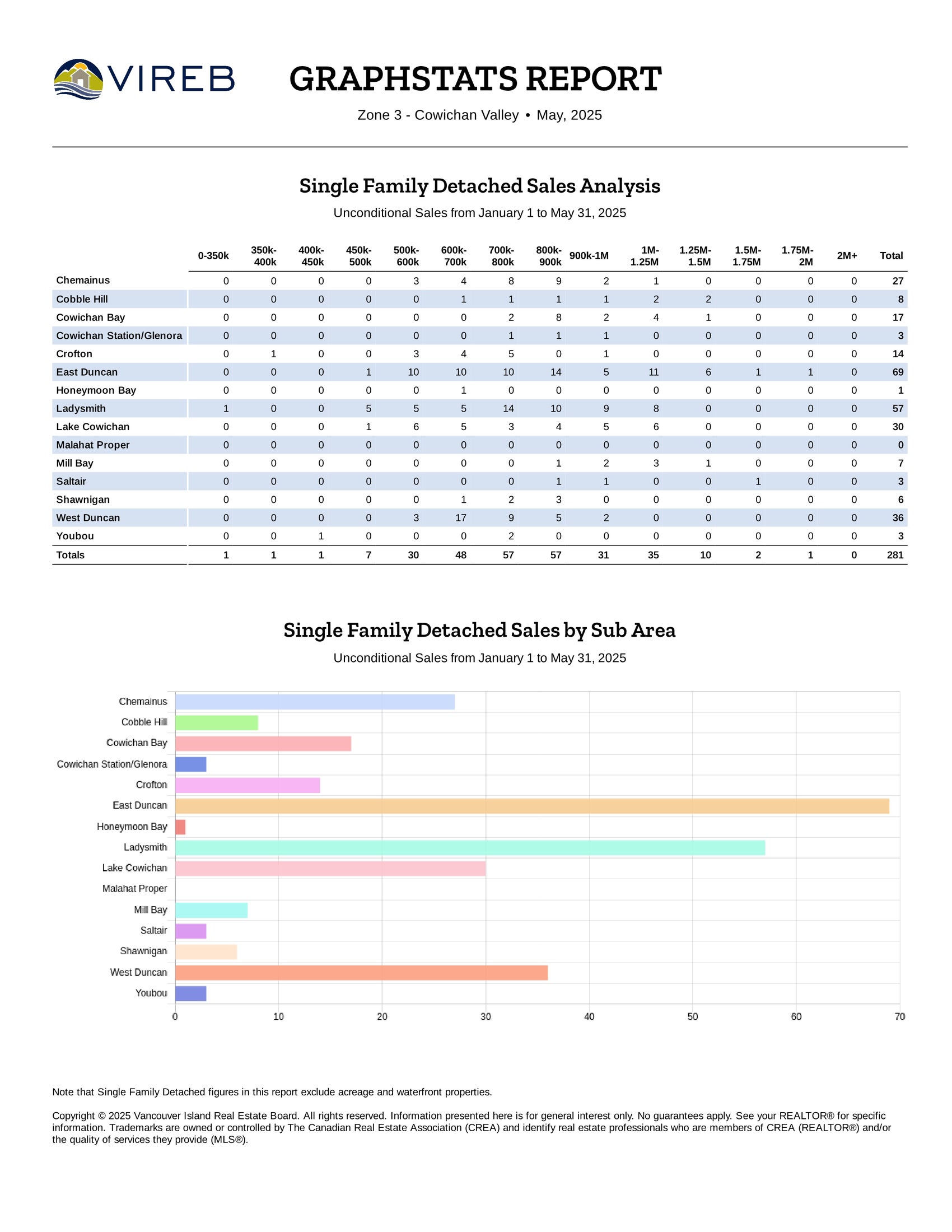

Condo & Townhome Market Update

Condominiums

In May, the condominium market saw an increase with 8 units sold, compared to 5 in April. However, sales are down from the 12 units sold in May of last year. The average price for condo apartments over the past 12 months ending in May 2025 rose to $351,442 - a 4% increase from last year's average of $337,550.

Townhomes

The townhome market experienced an up/downward trend, with 11 sales in May, an increase from the 9 units sold in April and decrease from the 20 in May 2024 (a 45% year-over-year decrease). The average price for townhomes over the past 12 months ending in May reached $559,846, down about 3% from $575,976 during the same period last year.

VICTORIA

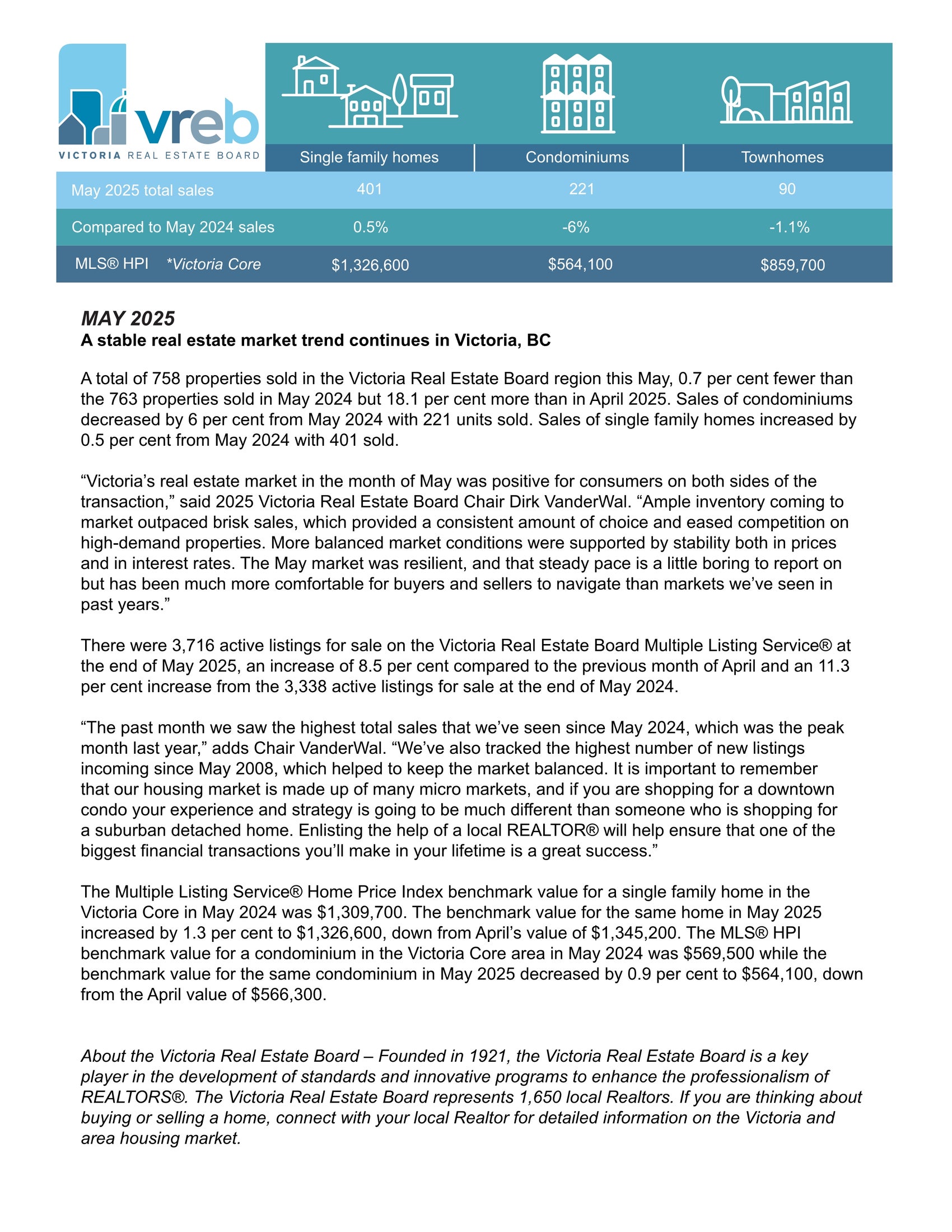

Summary: In May 2025, the benchmark price for single-family homes in the Victoria Core reached $1,326,600, reflecting a 0.5% year-over-year increase.

Bank of Canada holds policy rate at 2¾%

Media Relations

Ottawa, Ontario

June 4, 2025

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

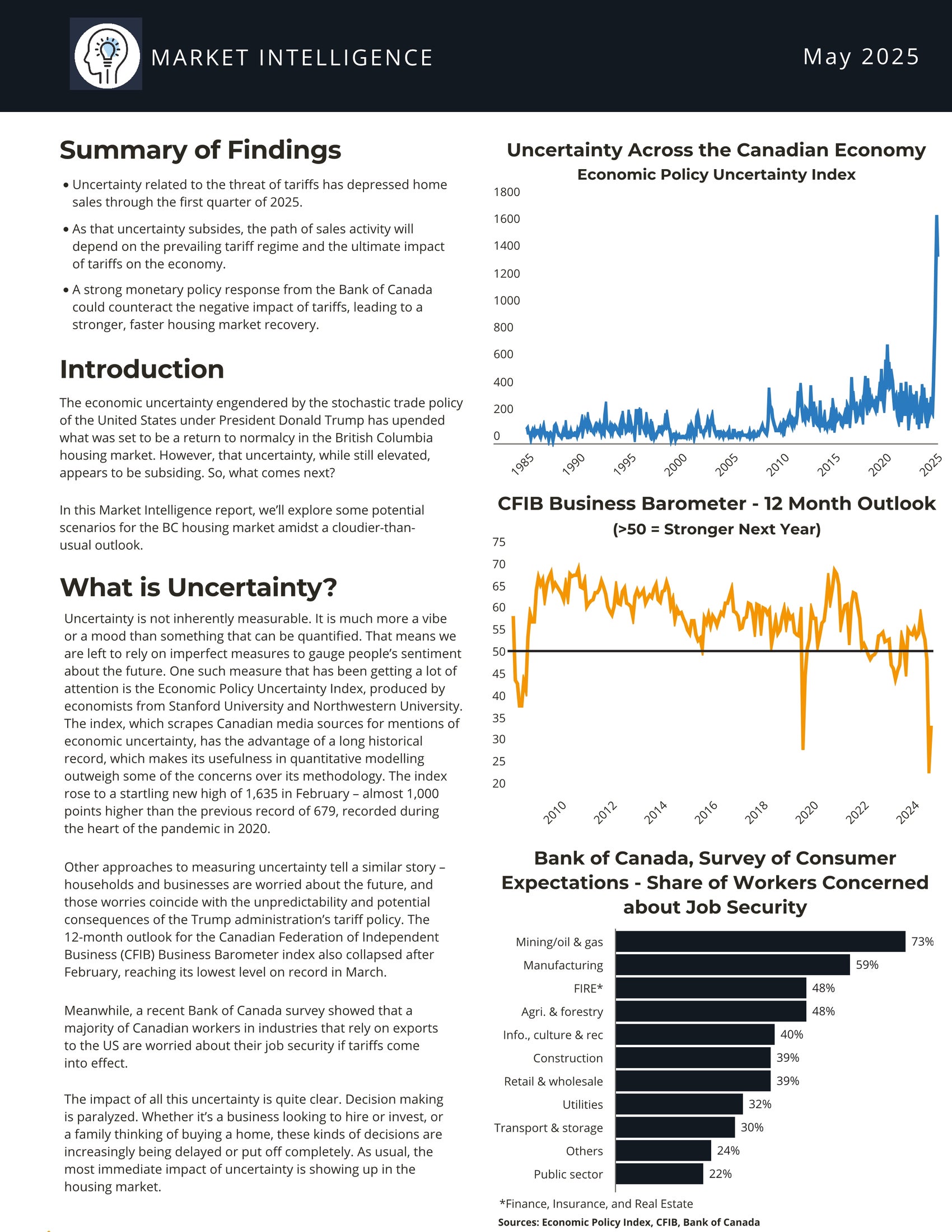

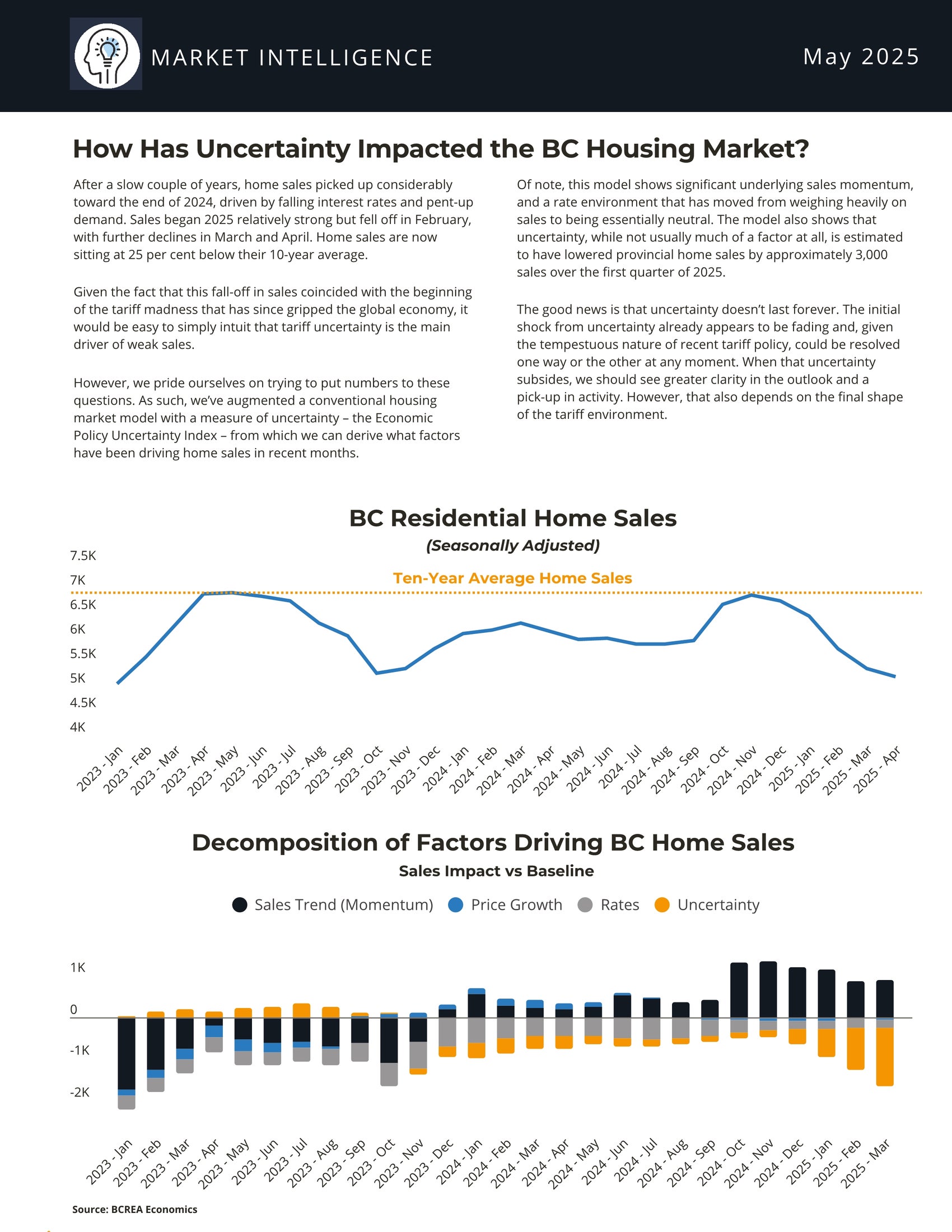

Since the April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the United States have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the outcomes of these negotiations are highly uncertain, tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high.

While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs. In the United States, domestic demand remained relatively strong but higher imports pulled down first-quarter GDP. US inflation has ticked down but remains above 2%, with the price effects of tariffs still to come. In Europe, economic growth has been supported by exports, while defence spending is set to increase. China’s economy has slowed as the effects of past fiscal support fade. More recently, high tariffs have begun to curtail Chinese exports to the US. Since the financial market turmoil in April, risk assets have largely recovered and volatility has diminished, although markets remain sensitive to US policy announcements. Oil prices have fluctuated but remain close to their levels at the time of the April MPR.

In Canada, economic growth in the first quarter came in at 2.2%, slightly stronger than the Bank had forecast, while the composition of GDP growth was largely as expected. The pull-forward of exports to the United States and inventory accumulation boosted activity, with final domestic demand roughly flat. Strong spending on machinery and equipment held up growth in business investment by more than expected. Consumption slowed from its very strong fourth-quarter pace, but continued to grow despite a large drop in consumer confidence. Housing activity was down, driven by a sharp contraction in resales. Government spending also declined. The labour market has weakened, particularly in trade-intensive sectors, and unemployment has risen to 6.9%. The economy is expected to be considerably weaker in the second quarter, with the strength in exports and inventories reversing and final domestic demand remaining subdued.

CPI inflation eased to 1.7% in April, as the elimination of the federal consumer carbon tax reduced inflation by 0.6 percentage points. Excluding taxes, inflation rose 2.3% in April, slightly stronger than the Bank had expected. The Bank’s preferred measures of core inflation, as well as other measures of underlying inflation, moved up. Recent surveys indicate that households continue to expect that tariffs will raise prices and many businesses say they intend to pass on the costs of higher tariffs. The Bank will be watching all these indicators closely to gauge how inflationary pressures are evolving.

With uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, Governing Council decided to hold the policy rate as we gain more information on US trade policy and its impacts. We will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.

Governing Council is proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy. These include: the extent to which higher US tariffs reduce demand for Canadian exports; how much this spills over into business investment, employment and household spending; how much and how quickly cost increases are passed on to consumer prices; and how inflation expectations evolve.

We are focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. We will support economic growth while ensuring inflation remains well controlled.

Information note

The next scheduled date for announcing the overnight rate target is July 30, 2025. The Bank will publish its next MPR at the same time.