Happy New Year! I hope 2026 is off to a great start for you and your family.

Cowichan Valley 2025 Recap & 2026 Outlook. Vancouver Island’s housing market, including the Cowichan Valley, moved through 2025 in a steady, resilient fashion despite higher borrowing costs and broader economic uncertainty. Across the Island, sales activity held up, and most areas saw modest price growth rather than dramatic swings—signs of a balanced market.

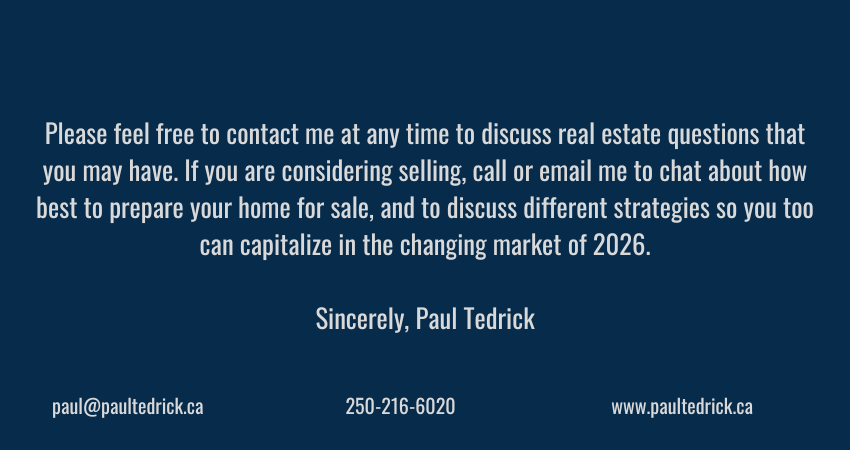

Here in the Cowichan Valley, single-family home values continued to trend gently upward over the year, underscoring the region’s appeal and long-term stability. Local market updates consistently described 2025 as a period of normalization, with a calmer pace and seasonal slowdowns but no sharp corrections, giving both buyers and sellers space to make more thoughtful, well-planned moves.

Buying at the peak — why some 2020–2022 buyers may lose money if selling now.

I’ve had several questions lately from homeowners who bought during the intense 2020–2022 market and are now thinking about selling. Many are discovering that their equity is thinner than expected, or even negative once all costs are accounted for. Those who got caught up in multiple offers at the peak and paid well over list can often expect a more significant loss because of the market corrections since then. Prices have largely flattened from those highs, and today’s higher interest rates and more balanced demand have kept a lid on further gains.

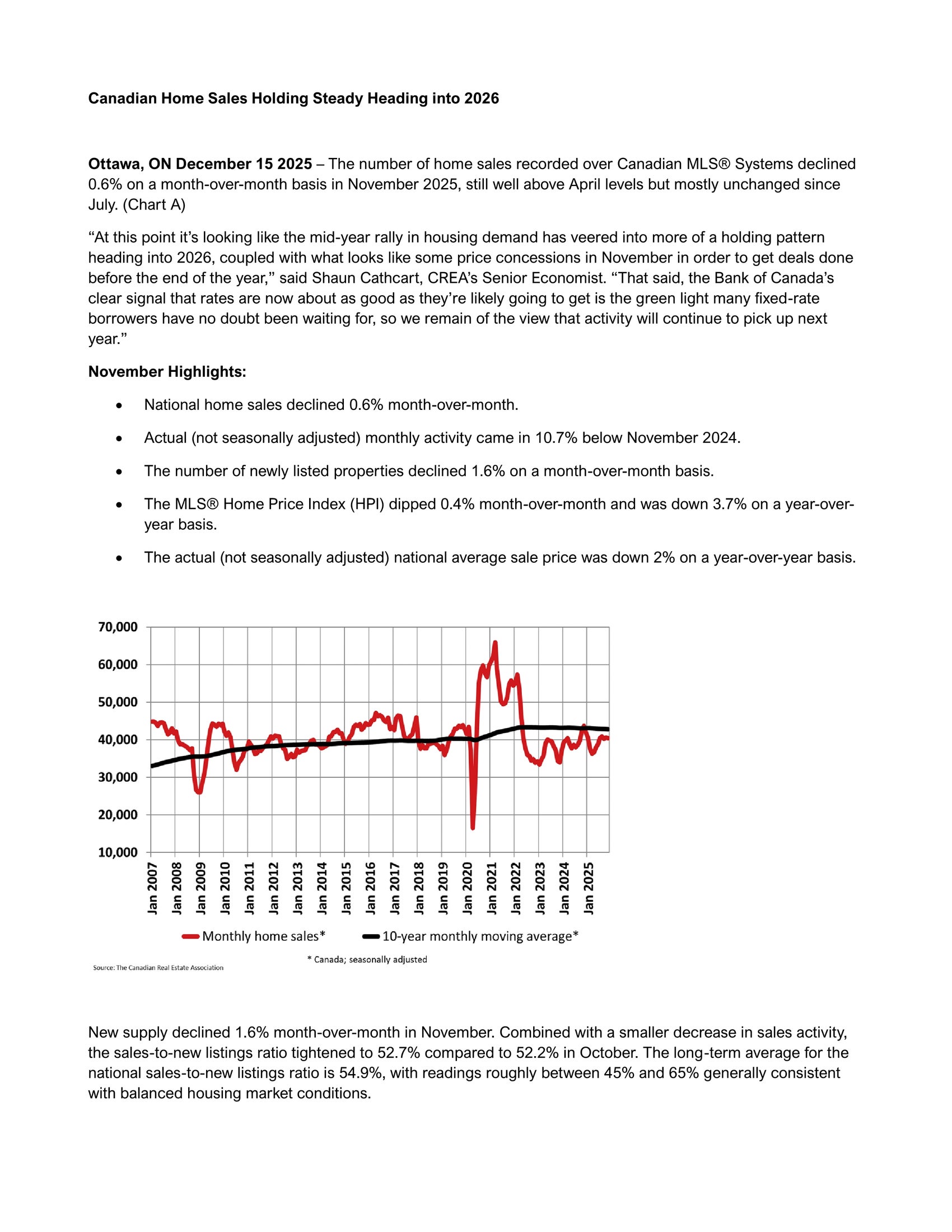

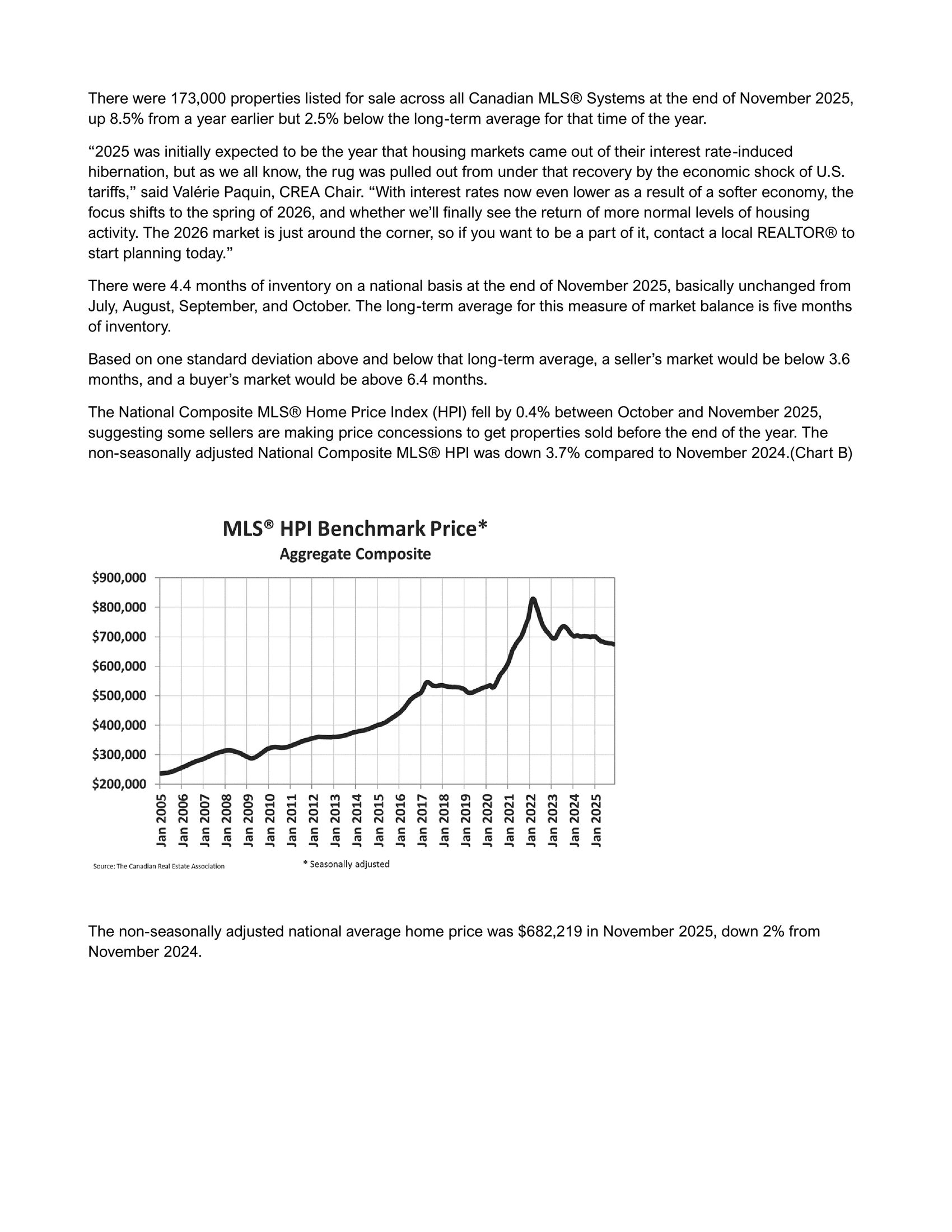

The Canadian real estate market in 2025 balanced out nationally with a slowdown in new construction and significant regional variations in price. Economic uncertainty moderated overall activity despite Bank of Canada rate cuts bringing the policy rate to 2.25% by December.

2025 Market Highlights

• Prices & Sales: National average prices saw a modest decline for the year. Sales were subdued in the first half but improved by the fall, though annual volume was down from 2024.

• Interest Rates: Several BoC rate cuts offered some relief to homeowners, supporting a fall sales bump.

• Supply Shortage: New home construction slowed due to high costs and builder hesitancy, maintaining a structural supply gap.

• Immigration Impact: Lower immigration targets eased pressure on the rental market, while demand from established residents continued to support ownership markets in major cities.

• Economic Headwinds: U.S. trade tensions created a climate of uncertainty, dampening consumer and business confidence.

Canada’s housing market in 2026 is expected to be a “reset” year, with more balanced conditions, modest price movement, and slightly stronger sales than 2025, rather than a return to the levels of 2020–2022. Most major forecasts point to small national price gains or near-flat performance, with regional differences based on affordability and local economies.

British Columbia’s housing market is expected to see a cautious rebound in 2026, with more sales but only modest price growth and plenty of regional variation. Forecasts point to a market that is more balanced than boom-like, with buyers having more choice and sellers adjusting expectations after a softer 2024–2025.

Cowichan Valley is expected to stay stable and balanced in 2026, with only modest price movement and a similar pace of sales to late 2025. Forecast commentary for Vancouver Island suggests no major shifts in local dynamics, and Cowichan Valley has been one of the more resilient sub markets compared with the Lower Mainland. VIREB characterizes the Island, including Cowichan Valley, as sitting at the high end of balanced territory, with around six months of inventory and typical seasonal slowdowns.

Questions around First Nations title have understandably been on a lot of people’s minds lately, especially with the recent Cowichan Tribes decision in the news. The headlines can sound unsettling, but it is important to remember that these cases are ultimately about clarifying long standing issues, not suddenly taking homes away from families. Over time, that clarity can be a positive for First Nations, municipalities, lenders, and homeowners.

Let’s take a closer look at how the market wrapped up last year across the South Island.

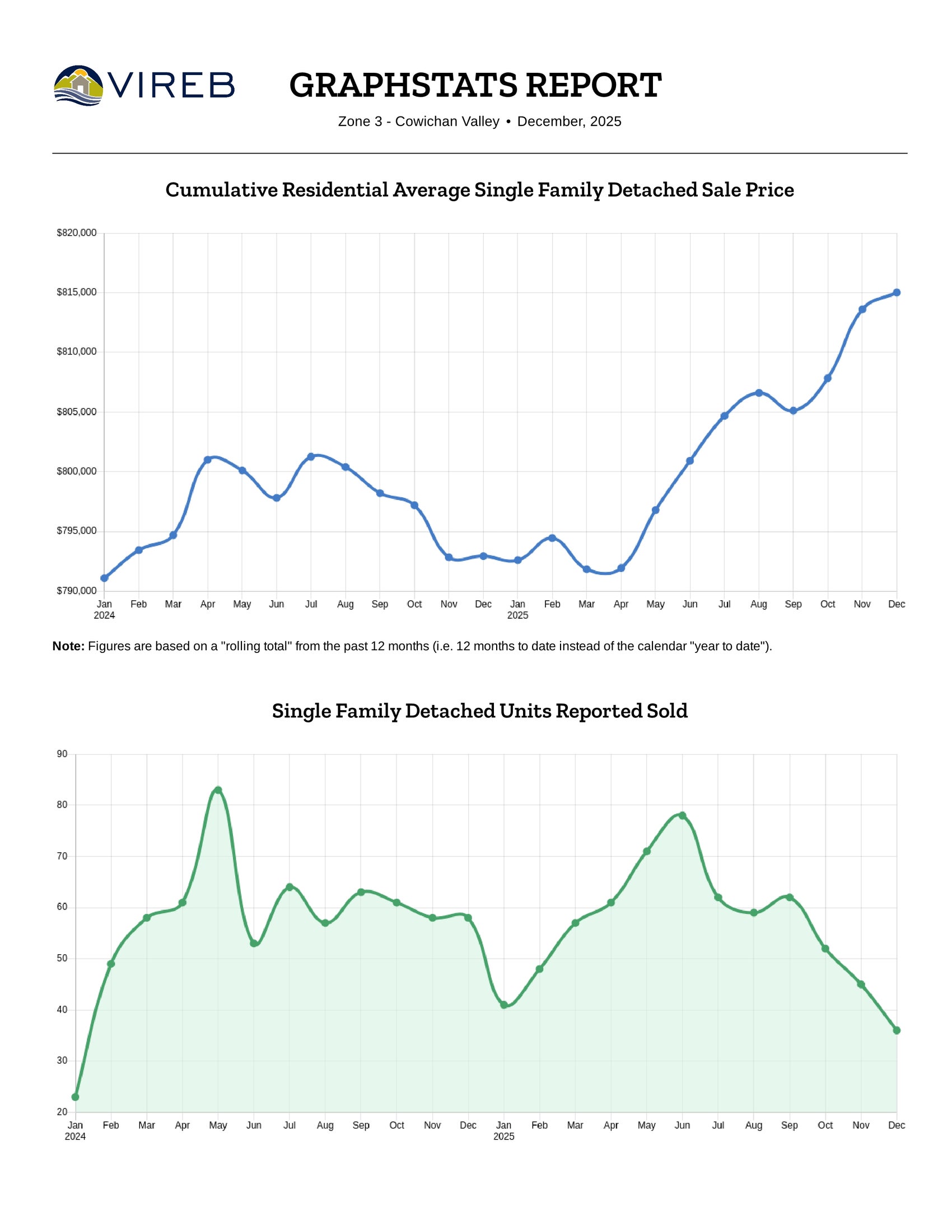

December 2025 Market Update — Cowichan Valley Single-Family Homes

Summary: As of December 2025, single-family homes recorded a 12-month median sale price of $790,000, reflecting appreciation of 2.78% from the prior year, and a sell-to-list ratio of 98%.

Sales Activity: A total of 36 single-family homes were sold in the Cowichan Valley during December 2025, marking a notable decrease from 58 homes sold in December 2024 (-38%) and down from 46 homes in November 2025.

Listings & Inventory: The market saw 29 new single-family home listings in December 2025, a sharp decline of almost 30% compared to 41 listings in December of last year. As of the end of December, 147 homes were actively listed, down from 158 homes available at the same time last year.

Pricing Trends:

• The average sale price in December 2025 was $799,419, reflecting an increase from December 2024’s average of $788,529.

• Compared to November 2025’s average of $826,504, prices have softened.

• For the 12-month period ending in December 2025, the median sale price stood at $790,000.

Annual Performance: Over the past 12 months, 672 single-family homes were sold, which represents a 2.3% decline compared to the 688 sales in the same period ending in December 2024. Despite the slower pace of sales, the average selling price for the year is up by 2.8%.

Market Supply & Days on Market:

• The supply of homes increased to 5.8 months in December 2025, up from 4.1 months in December 2024.

• Homes sold in December 2025 spent an average of just 25 days on the market, a significant improvement from 78 days in December 2024. Looking at the 12 month trend, the average days to sell remained steady — 49 days in 2025 compared to 50 days in 2024.

This summary highlights the key market trends and performance for single-family homes in the Cowichan Valley, helping homeowners and buyers stay informed about the latest developments. Feel free to reach out for further details or if you need personalized advice!

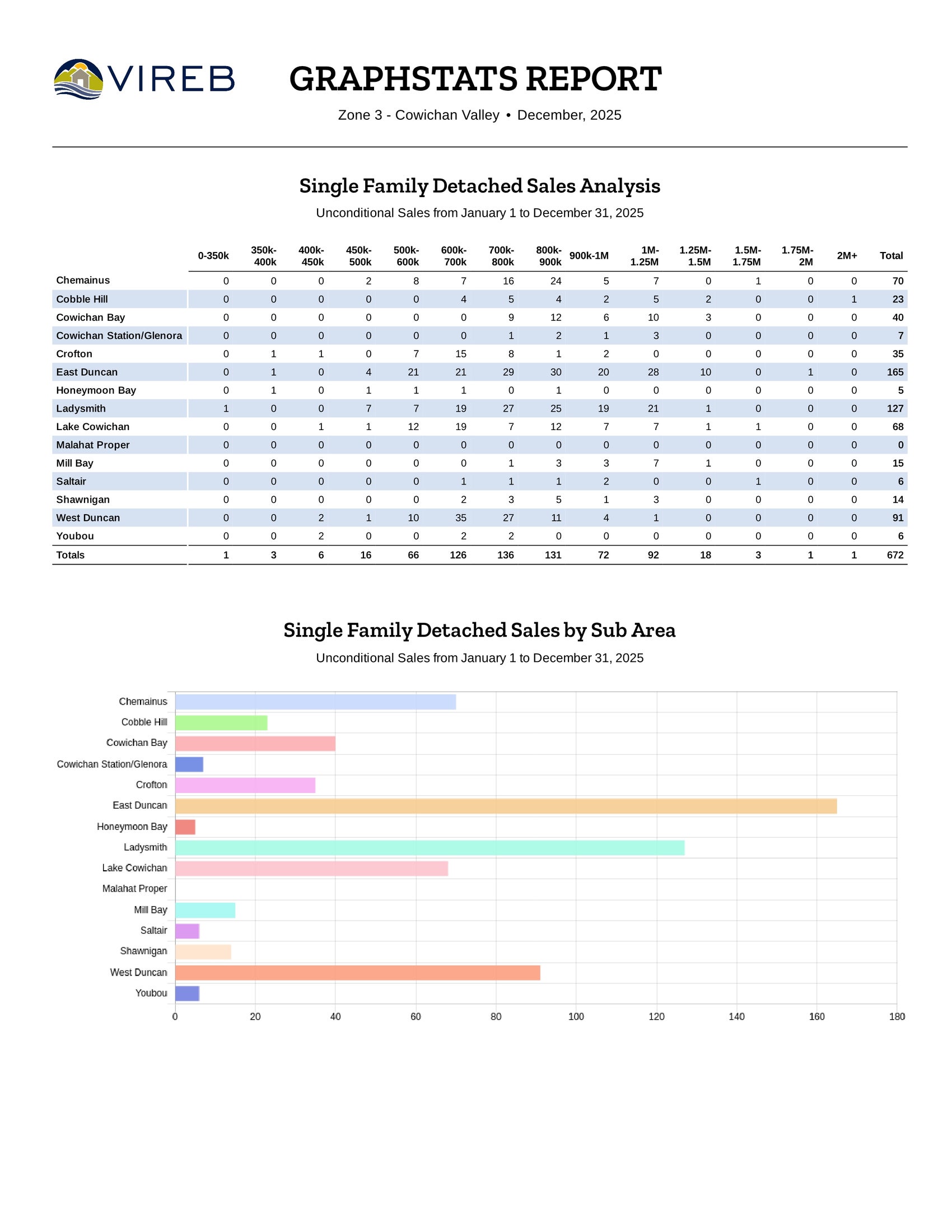

Condo & Townhome Market Update

Condominiums

In December, the condominium market saw a decrease with 7 units sold, in comparison to November’s 10 units. However, sales are up from the 5 units sold in December of last year. The average price for condo apartments over the past 12 months ending in December 2025 rose to $349,719 - a 0.5% decrease from last year's average of $351,446.

Townhomes

The townhome market experienced a downward trend, with 6 sales in December, a decrease from both the 7 units sold in November and 12 in December 2024 (a 50% year-over-year decrease). The average price for townhomes over the past 12 months ending in December reached $562,168, down 0.7% from $565,963 during the same period last year.

VICTORIA

Summary: In December 2025, the benchmark price for single-family homes in the Victoria Core reached $1,255,000, reflecting a 2.6% year-over-year decrease.

Bank of Canada maintains policy rate at 2¼%

December 10, 2025

The Bank of Canada today held its target for the overnight rate at 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%.

Major economies around the world continue to show resilience to US trade protectionism, but uncertainty is still high. In the United States, economic growth is being supported by strong consumption and a surge in AI investment. The US government shutdown caused volatility in quarterly growth and delayed the release of some key economic data. Tariffs are causing some upward pressure on US inflation. In the euro area, economic growth has been stronger than expected, with the services sector showing particular resilience. In China, soft domestic demand, including more weakness in the housing market, is weighing on growth. Global financial conditions, oil prices, and the Canadian dollar are all roughly unchanged since the Bank’s October Monetary Policy Report (MPR).

Canada’s economy grew by a surprisingly strong 2.6% in the third quarter, even as final domestic demand was flat. The increase in GDP largely reflected volatility in trade. The Bank expects final domestic demand will grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.

Canada’s labour market is showing some signs of improvement. Employment has shown solid gains in the past three months and the unemployment rate declined to 6.5% in November. Nevertheless, job markets in trade-sensitive sectors remain weak and economy-wide hiring intentions continue to be subdued.

Canada’s labour market is showing some signs of improvement. Employment has shown solid gains in the past three months and the unemployment rate declined to 6.5% in November. Nevertheless, job markets in trade-sensitive sectors remain weak and economy-wide hiring intentions continue to be subdued.

CPI inflation slowed to 2.2% in October, as gasoline prices fell and food prices rose more slowly. CPI inflation has been close to the 2% target for more than a year, while measures of core inflation remain in the range of 2½% to 3%. The Bank assesses that underlying inflation is still around 2½%. In the near term, CPI inflation is likely to be higher due to the effects of last year’s GST/HST holiday on the prices of some goods and services. Looking through this choppiness, the Bank expects ongoing economic slack to roughly offset cost pressures associated with the reconfiguration of trade, keeping CPI inflation close to the 2% target.

If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. Uncertainty remains elevated. If the outlook changes, we are prepared to respond. The Bank is focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval.

Information note: The next scheduled date for announcing the overnight rate target is January 28, 2026. The Bank’s next MPR will be released at the same time.