The March real estate market is underway with a strong start and inventory continues to increase, a seasonal norm for this time of year. We are still in a balanced market at most price points, with the average days to sell last month at 55 days. Home buyer apprehension surrounding interest rates has found some stability with the recent decision by the Bank of Canada to maintain the prime rate. As we transition into spring, the real estate market maintains its positive momentum.

Thinking about real estate? Don't miss out on the best time of year. Whether buying, selling, or needing advice, I'm here to help. Reach out anytime for assistance.

Kind regards, Paul

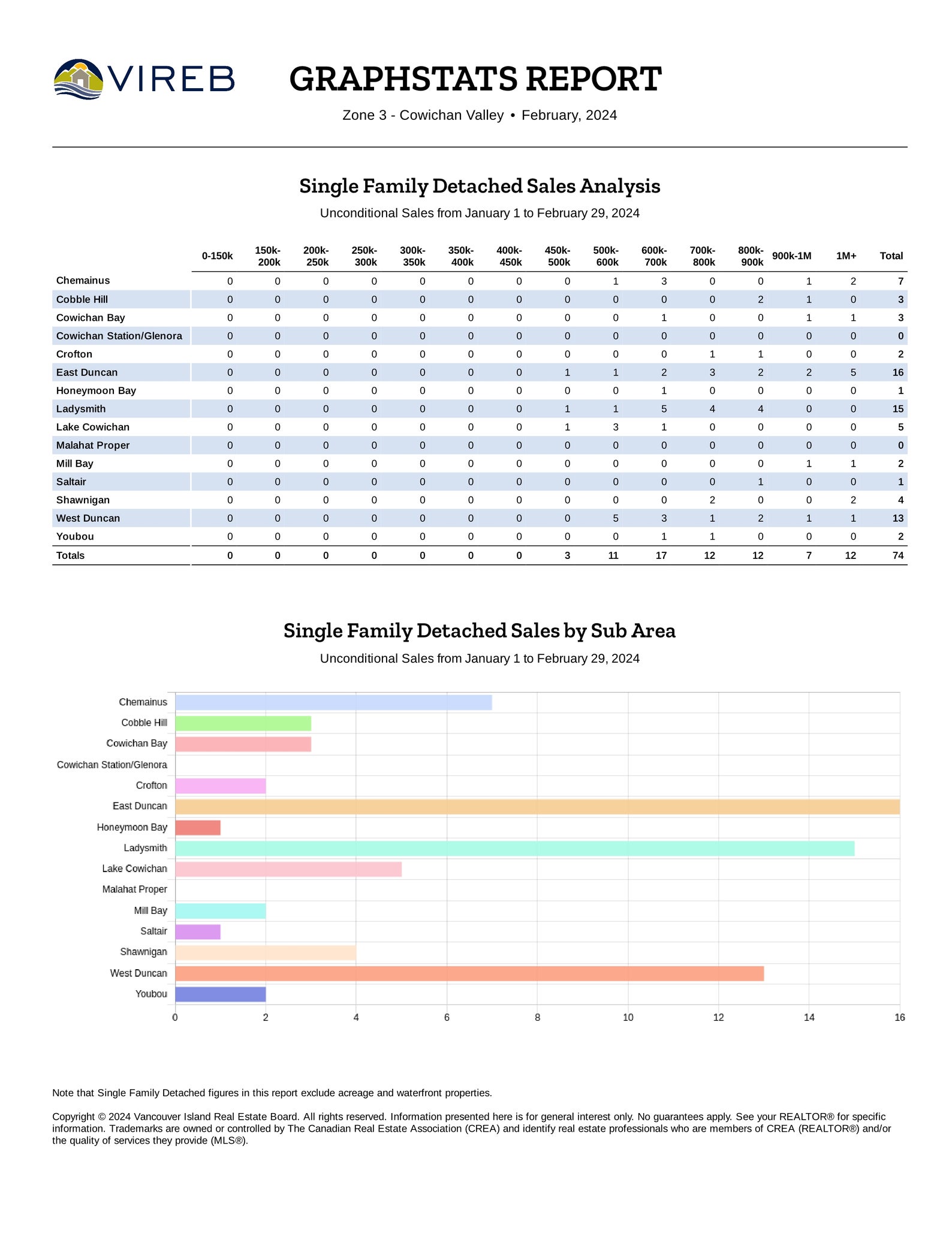

February 2024 Statistics for Single Family Dwellings in the Cowichan Valley

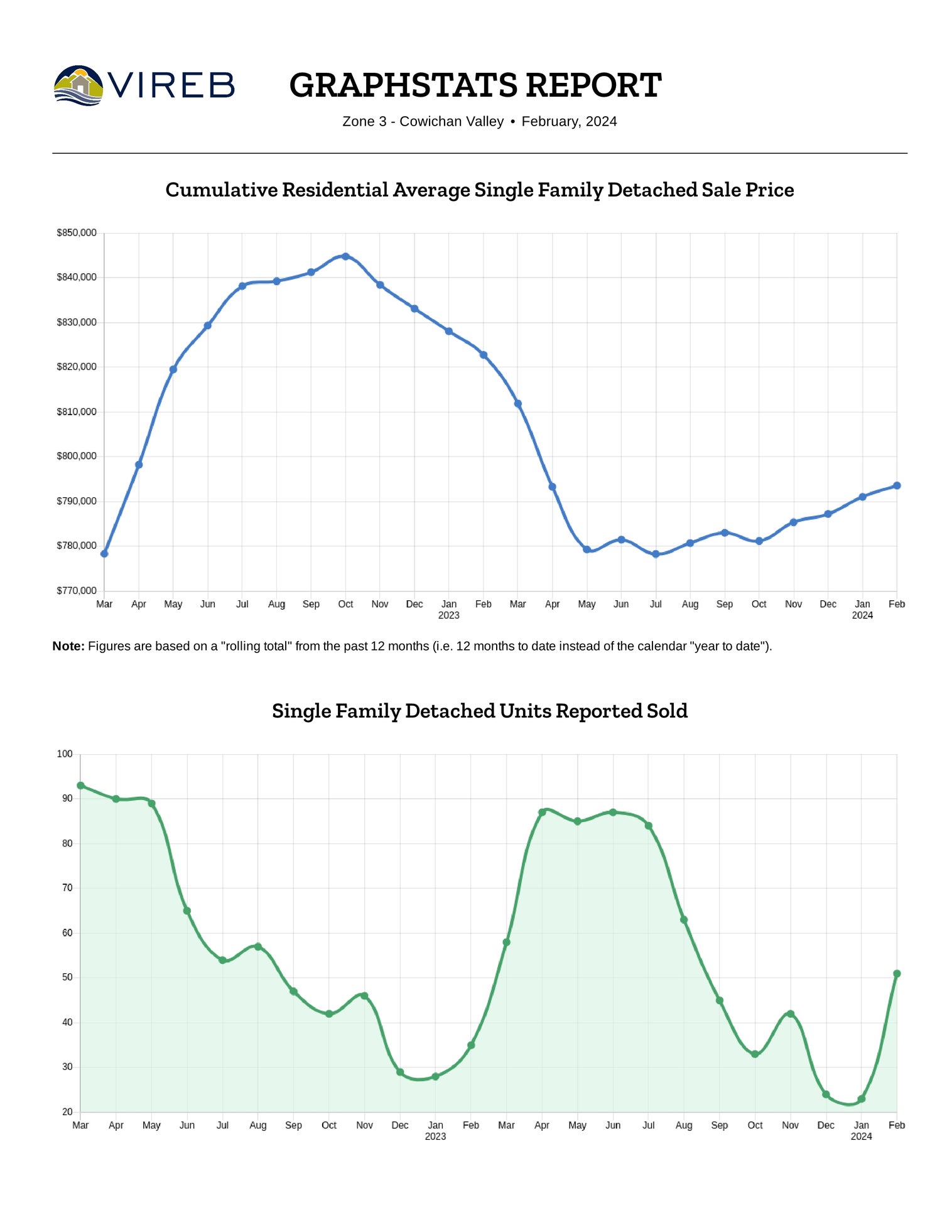

February saw a total of 51 single-family homes sold in the Cowichan Valley, up considerably from the 35 that sold in February of last year, and more than double from the 23 in the preceding month of January. There were 95 single-family homes listed on the market in February 2024 compared to 89 last year, up about 7%. There were 682 sales in our valley over the past 12 months to date representing a 1% increase in comparison to the 675 sales in the 12 months ending in February of last year.

Average prices for single-family residential homes in February 2024 were at $805,578, up about 6% from $761,080 in February 2023, and up from January’s average of $773,230. The median price of a single-family home in the Cowichan Valley for the 12 months to date ending in February 2024 was $775,000.

In February, the active inventory of single-family homes on the market in the Cowichan Valley was 328, up from the 292 homes at the end of February 2023.

We had a 4.4-month supply of single-family homes on the market last month, while February 2023 had a 6.3-month supply. The average days to sell a single-family home in February was 55 days, down from 65 days last February.

Condos & Townhouses

Condominium apartment sales in February saw 10 units sold, up from 3 sales in the previous month of January, and equal to the 10 units that sold last February. Condo apartments in the valley saw the average price for the 12 months ending in February 2024 at $335,142, down 5% for the same period as last year, $352,889.

The inventory of Townhomes on the market saw 8 sales in February, down from the 13 that sold in the month of January, and up from the 7 sold last February, a 14.3% increase. Townhomes in the valley saw the average price for the 12 months to date ending in February at $568,342, down 8.8% from $622,880 for the same period last year.

BC Government Announces New Housing Measures in 2024 Budget

February 22, 2024

This afternoon, Finance Minister Katrine Conroy introduced the provincial government's Budget 2024. The budget unveiled several new housing related measures, including the BC Home Flipping Tax and various property transfer tax exemptions.

While BCREA commends the provincial government's renewed commitment and efforts to improve housing attainability for British Columbians, the budget's introduction of a "flipping tax" is unlikely to have a meaningful impact on housing attainability.

Flipping Tax

The BC Home Flipping Tax is a 20 per cent tax on the gain from sale of a home within a one-year time horizon and a pro-rated tax on sales up to within a two-year period. The tax will apply to both properties and assignments of contracts and is in addition to any existing federal or provincial income taxes incurred from the sale of the property, including the federal anti-flipping tax. Exemptions will be available for certain life circumstances that might motivate the sale of a property within two years, including for added supply through the creation of rental accessory dwelling units.

The BCREA Economics Department's preliminary analysis estimates the flipping tax will decrease home sales by between 1-2 per cent over a three-year period. Given the relatively small impact, prices and housing attainability are essentially unchanged by the tax. This is unsurprising, given that short-term flipping represents a low share of sales activity (less than 2 per cent in both Vancouver and Victoria).

However, because the government has now implemented a disincentive to sell within a two-year period after purchasing, there will be some potential sellers that are prompted to delay listing, resulting in a lower level of listings inventory than without the tax. As a result, home prices may increase with the flipping tax compared to a no-tax baseline. Ultimately, the only way to prevent harmful short-term speculation in the housing market is to ensure housing is abundant. Our team plans to continue to analyze the flipping tax and provide updates when available.

Property Transfer Tax Exemptions

In principle, BCREA supports reduced property transfer taxes for first-time home buyers and people purchasing newly constructed homes. However, while we're in favour of measures that increase first-time home buyers' abilities to purchase properties, it's critically important that housing supply is increased so they aren't caught in bidding wars to acquire those homes. More detail is needed on property transfer tax exemption for purpose-built rentals to understand its impact on housing attainability for British Columbians.

BCREA will continue to advocate for more thoughtful and evidence-based policies that can genuinely move the needle on housing attainability and alleviate the housing crisis facing British Columbians.

In early March, BCREA and delegates from real estate boards across the province will be taking part in our annual Government Liaison (GL) Days in Victoria. During this time, we will be meeting with MLA's representing all parties and advocating for the establishment of a permanent housing roundtable where stakeholders such as BCREA can advise on housing policy prior to its introduction and implementation. Stay tuned to BCREA channels for more details about GL Days.

If you have any questions or comments, please email gr@bcrea.bc.ca.

Sincerely,

Trevor Hargreaves

Senior VP, Government Relations, Marketing & Communications

First Time Home Buyers' Program

Last updated on February 26, 2024

The first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. If you qualify for the program, you may be eligible for either a full or partial exemption from the tax.

If one or more of the purchasers do not qualify, only the percentage of interest that the first time home buyer(s) have in the property is eligible.

For example, if you acquired 60% interest in the property and another person acquired 40% interest but only you meet the qualifications, only your 60% would receive the exemption.

To learn more, please follow this link to the government site: https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/exemptions/first-time-home-buyers#

Newly Built Home Exemption

Last updated on February 28, 2024

The newly built home exemption reduces or eliminates the property transfer tax on qualifying purchases of a principal residence.

Full exemption: Effective April 1, 2024, the fair market value threshold for a full exemption for newly built homes is increased from $750,000 to $1,100,000.

Partial exemption: A partial exemption is also available for properties with fair market values just above the threshold. The phase out range is $50,000 above the threshold, with the complete elimination of the exemption at $1,150,000 for qualifying purchasers.

To learn more click the link to the government site here: https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/exemptions/newly-built-home-exemption

Bank of Canada Holds Prime once again, remains at 7.2% for households.

Key take-aways/language from today's announcement

• "still concerned about the risks to inflation and wants to see further and sustained easing in core inflation"

• CPI inflation eased in Jan however, Shelter costs remains elevated and is the biggest contributor to inflation

• The CDN economy is experiencing slow growth, but the situation is not deteriorating rapidly, with an expansion rate of approx. 1%

• Canadian 5yr bond is up slightly this morning, fixed rates lead indicator

Next B of C rate decision is April 10, 2024